US foodservice distribution market is sizeable (~250-300B USD) and fragmented; recently evolving with changing preferences of foodservice operators and potential disruptors such as e-commerce players and large grocery wholesalers. It is crucial for incumbent foodservice distributors to be aware of this threat and take necessary actions to react and stay competitive.

Executive Summary

Foodservice distribution is a complex business that involves managing a vast network of distribution points, ensuring the transportation of perishable products with cold chain, and dealing with high costs associated with transportation and logistics. Despite these complexities, it is an attractive business with its size of the potential. Potential disruptors such as grocery wholesalers (i.e. club stores, cash & carry operators, commercial wholesale outlets) and e-commerce players may further intensify the pressure on incumbent foodservice distributors.

Recently, e-commerce players and large grocery wholesalers with digital capabilities and vast geographical footprints have started to eye on B2B distribution, leveraging their experience in the B2C markets. Some of these players have already started to gain market share in several B2B distribution areas such as electronics, IT products, office supplies etc. It appears that the next target may be the foodservice distribution. Therefore, it is crucial for incumbent foodservice distributors to be aware of this threat and take necessary actions to react, adapt and stay competitive.

Foodservice distribution market is sizeable and fragmented; recently evolving with changing preferences of foodservice operators and potential disruptors

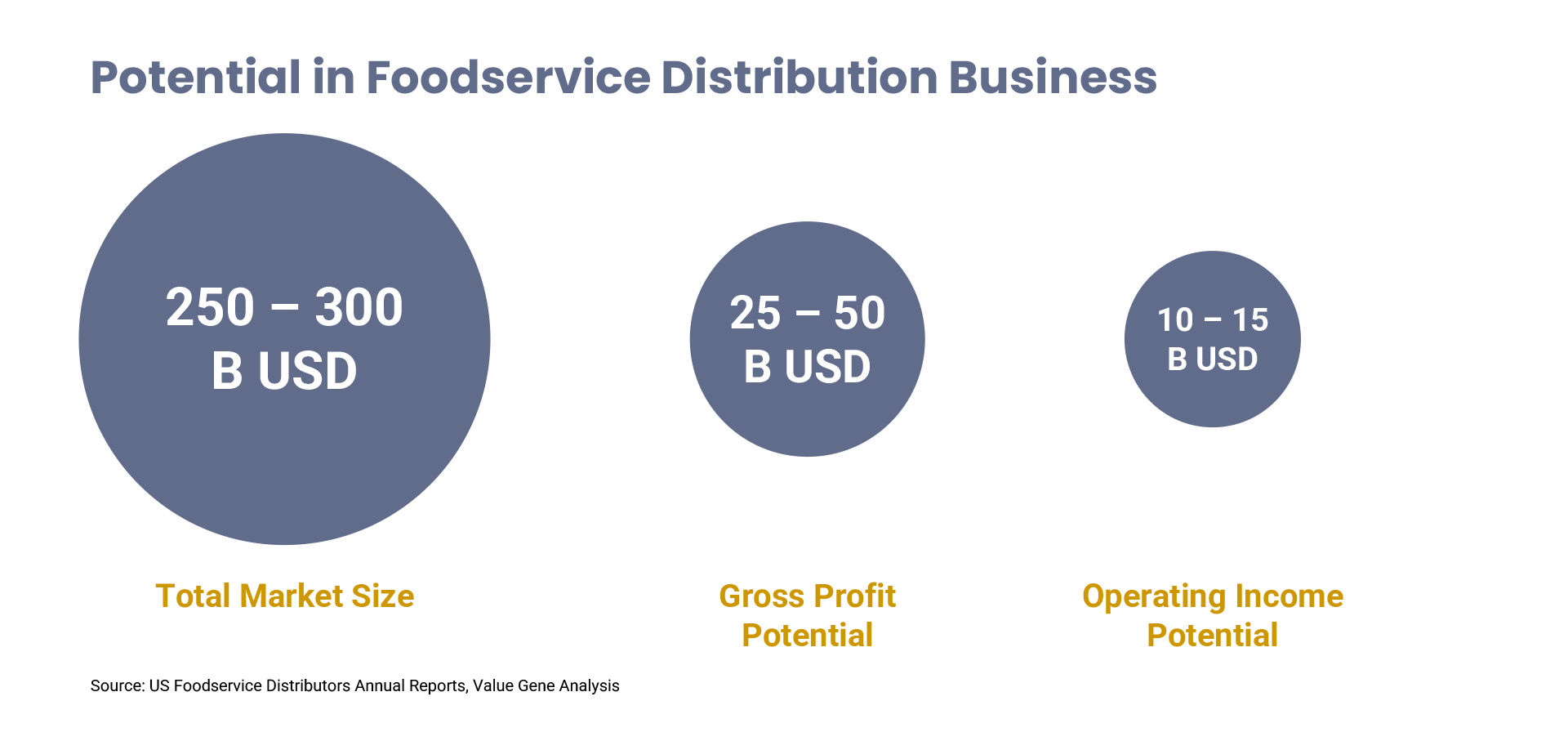

The foodservice distribution in the US is a 250-300 B USD market. Size of the potential makes the market attractive for potential disruptors which may develop a better cost-to-serve model to capture market share.

Exhibit 1

Given their potential for digital service, restaurants can be a prime target. They are the largest customer segment accounting for ~60% of the total size of the foodservice distribution market and are often looking for more cost-effective and convenient ways to order products. Their decision makers who are usually the chefs have a behavioral trend of getting accustomed to making online purchases. E-commerce players may use their data to better understand the purchasing patterns and preferences of chefs and offer more personalized products and services.

Fragmented competition opens a door for potential disruptors

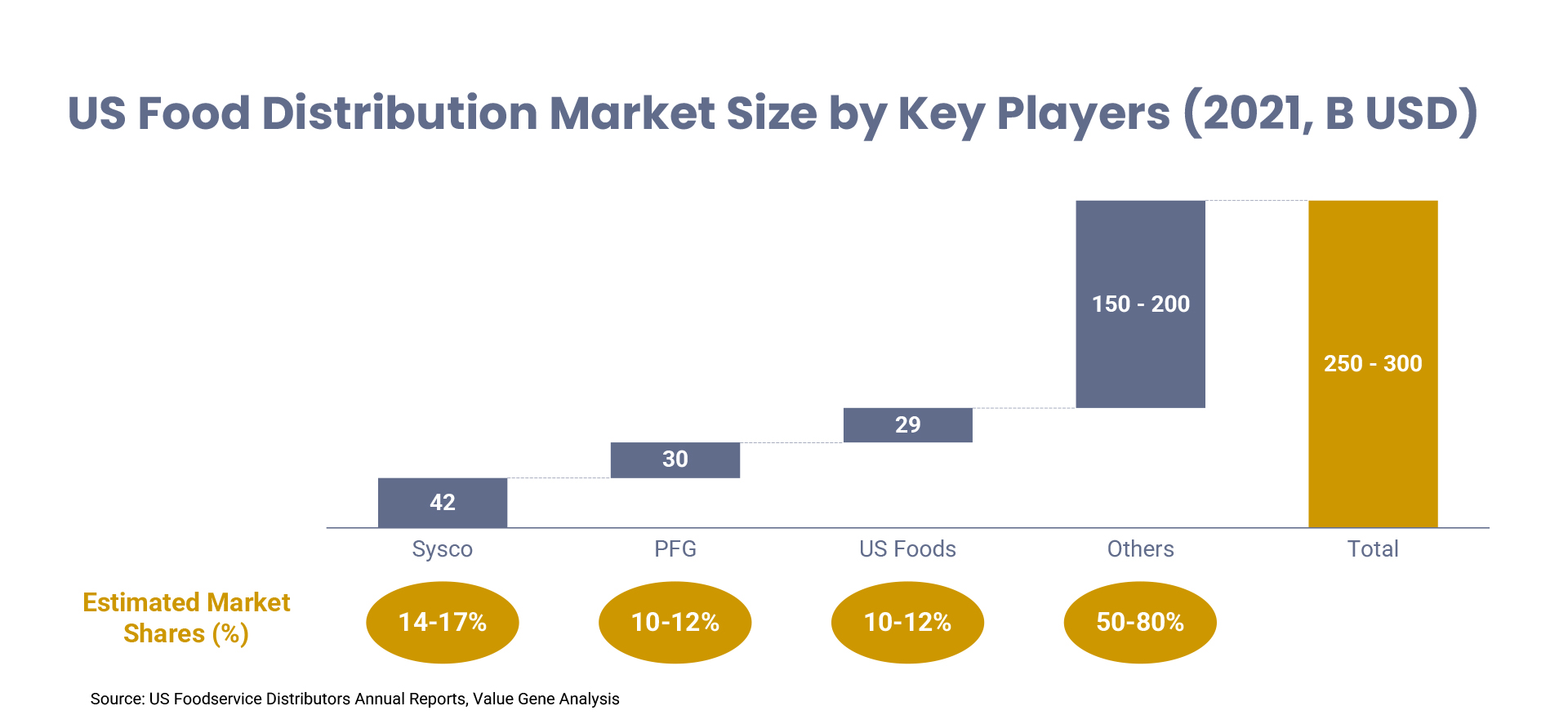

Foodservice distribution market is quite fragmented with a variety of local, regional, and national distributors, as well as specialty players. Around 35-40% of the market is served by 3 players: Sysco, US Foods, and Performance Food Group (known as PFG). The remaining portion of the foodservice distribution is fragmented with many players that have local and regional presences alongside with large chains having their own distribution. Fragmentated competition presents an opportunity for the potential disruptors.

Exhibit 2

Evolving foodservice distribution market in the US

In recent years, the foodservice distribution market has been evolving by (1) changing customer preferences and (2) disruptors having large geographic footprint with established digital capabilities.

1. Changing preferences of foodservice operators:

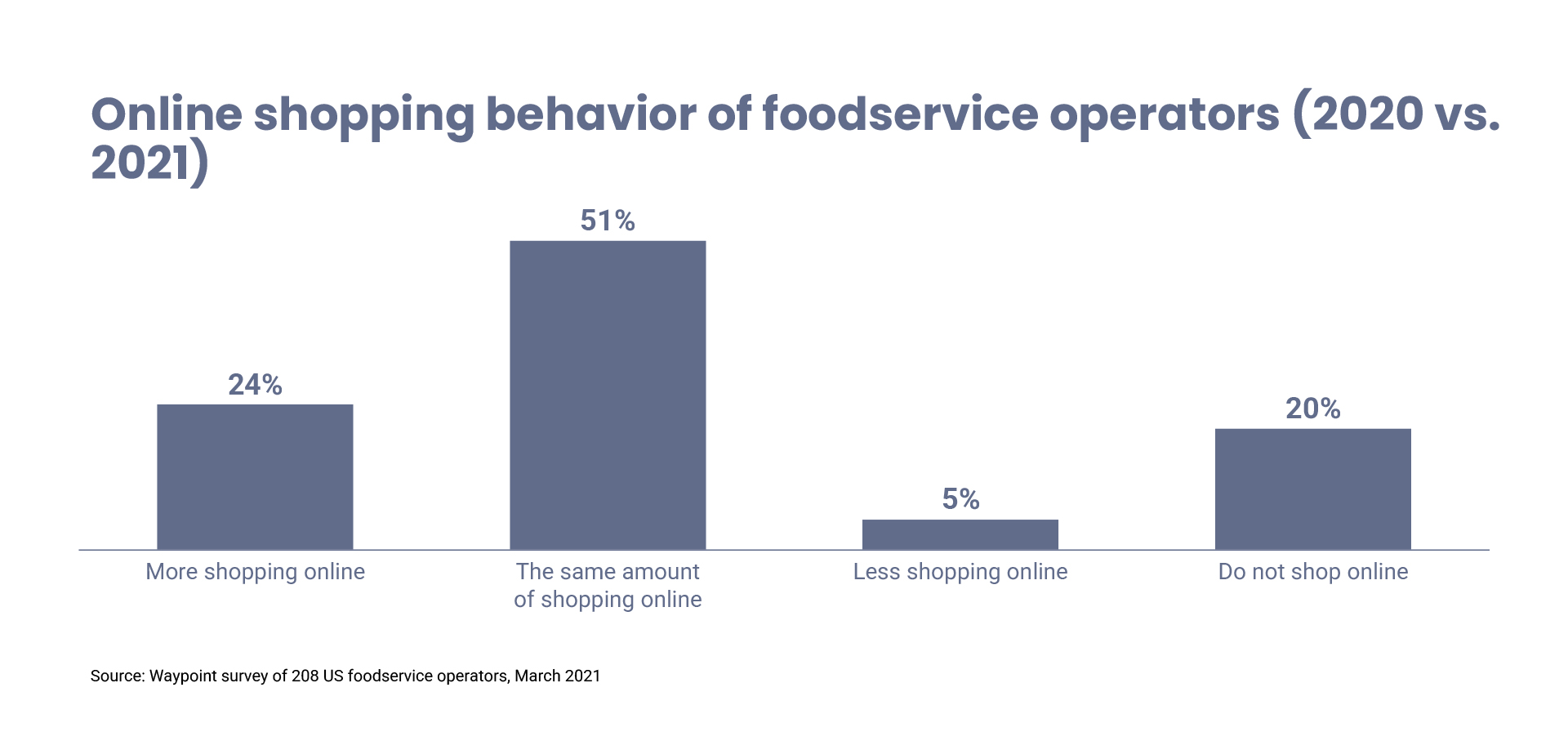

One major trend that has accelerated because of the pandemic is the increased adoption of e-commerce and digital platforms. The rise of e-commerce players has set a high bar for customer experience, and customers started to expect the same level of experience for their own businesses as well. Switch to e-commerce in the B2B market has been already ignited. A survey conducted among foodservice operators in the US reveals that 80% of operators somehow use online platforms in their procurement journey, while one fourth of the foodservice operators do “more shopping online”.

Exhibit 3

Foodservice operators increasingly expect better customer experience with transparency in procurement journey, alongside with a broader product portfolio and competitive prices. They also expect more frequent deliveries whereas incumbent foodservice distributors have purely relied on a business model that focuses on maximizing order size and minimizing the number of deliveries. The model may not be the best customer-oriented since customers are increasingly looking for more frequent and smaller batch deliveries. Additionally, many incumbent foodservice distributors may lack the resources or technology to meet customer expectations, leaving an opening for the potential disruptors to step in and provide better value to the customers.

2. Increasing relevance of disruptors having large geographic footprint with established digital capabilities:

The industry has seen different types of competitors in recent years, and there could be two major potential disruptors which are (1) e-commerce players like Amazon and (2) large grocery wholesalers such as Sam’s Club, Walmart Business.

2.1 E-commerce players can have a potential to disrupt the foodservice distribution by leveraging their knowledge in B2C markets

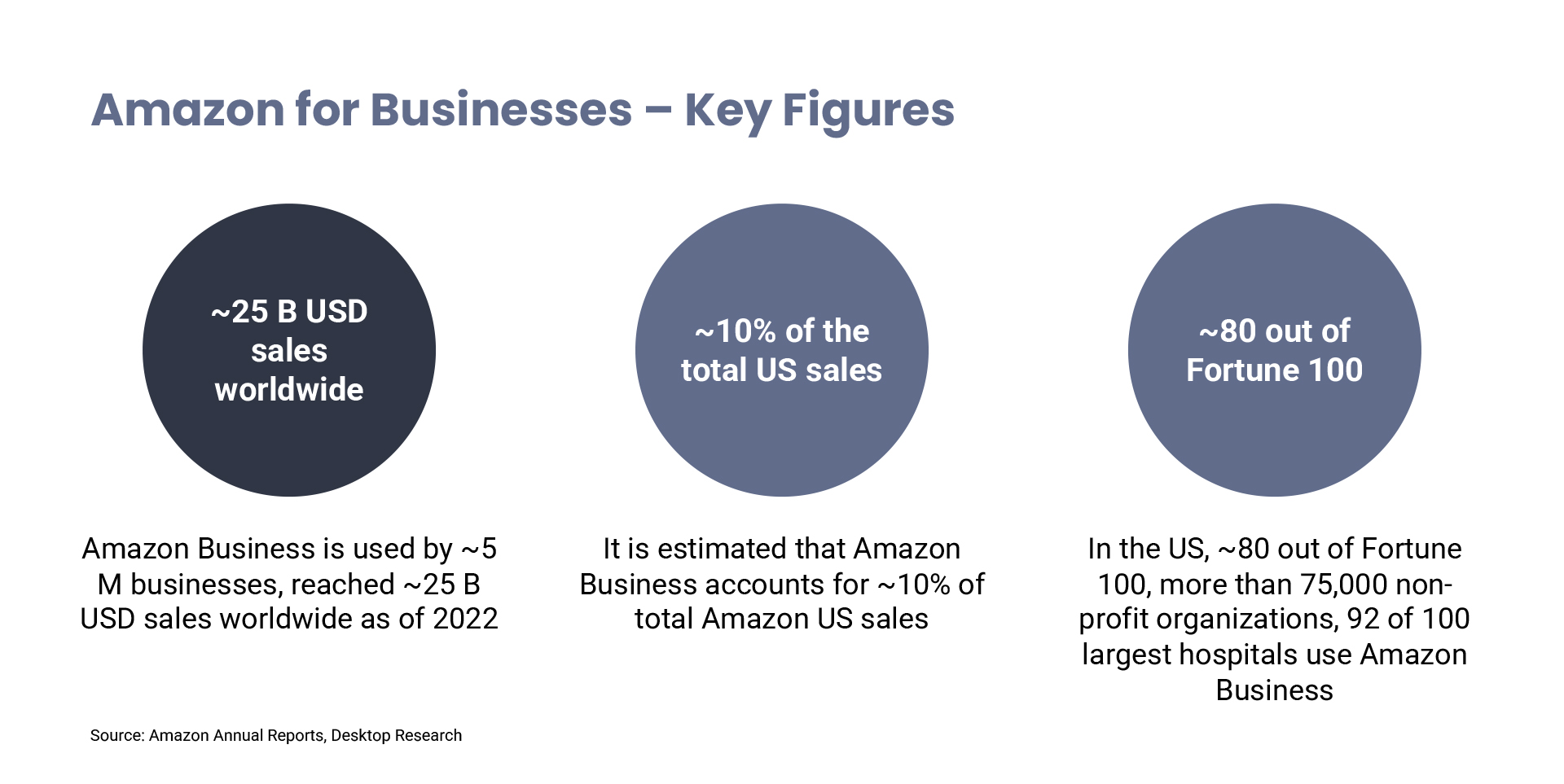

Large e-commerce players had a significant impact on various industries that they have entered with their ability to get products in customers’ hands fast. These companies have disrupted traditional brick-and-mortar businesses by providing customers with more convenient and personalized shopping experiences. They are leveraging their knowledge and supply chain networks they gained from B2C markets to provide similar benefits to B2B customers. This could include providing a wider range of products at more competitive prices, as well as more convenient, efficient, and user-friendly ordering and delivery services at every stage of the customer procurement journey. For instance, Amazon Business, launched in 2015, is a global procurement solution that brings a vast network of suppliers and acts as a solution provider for enterprises. It also provides a B2B marketplace for its customers, serving to more than 15 industries. For SMEs, they offer services like spend intelligence including analytics insights, optimization of cash flow and purchasing optimization including onboarding buyers, operation optimization, cost savings etc. Amazon Business still have not made a big move for foodservice distribution, but it wouldn’t be a big surprise if they make it soon.

Exhibit 4

2.2 Large grocery wholesalers may be potential disruptors with their advantage of being closer to the foodservice operators

Another potential disruptor that has been gaining attention in recent years is large grocery wholesalers. These companies have significant resources with wide reach in the US, and they may use them to shake up the traditional foodservice distribution ecosystem.

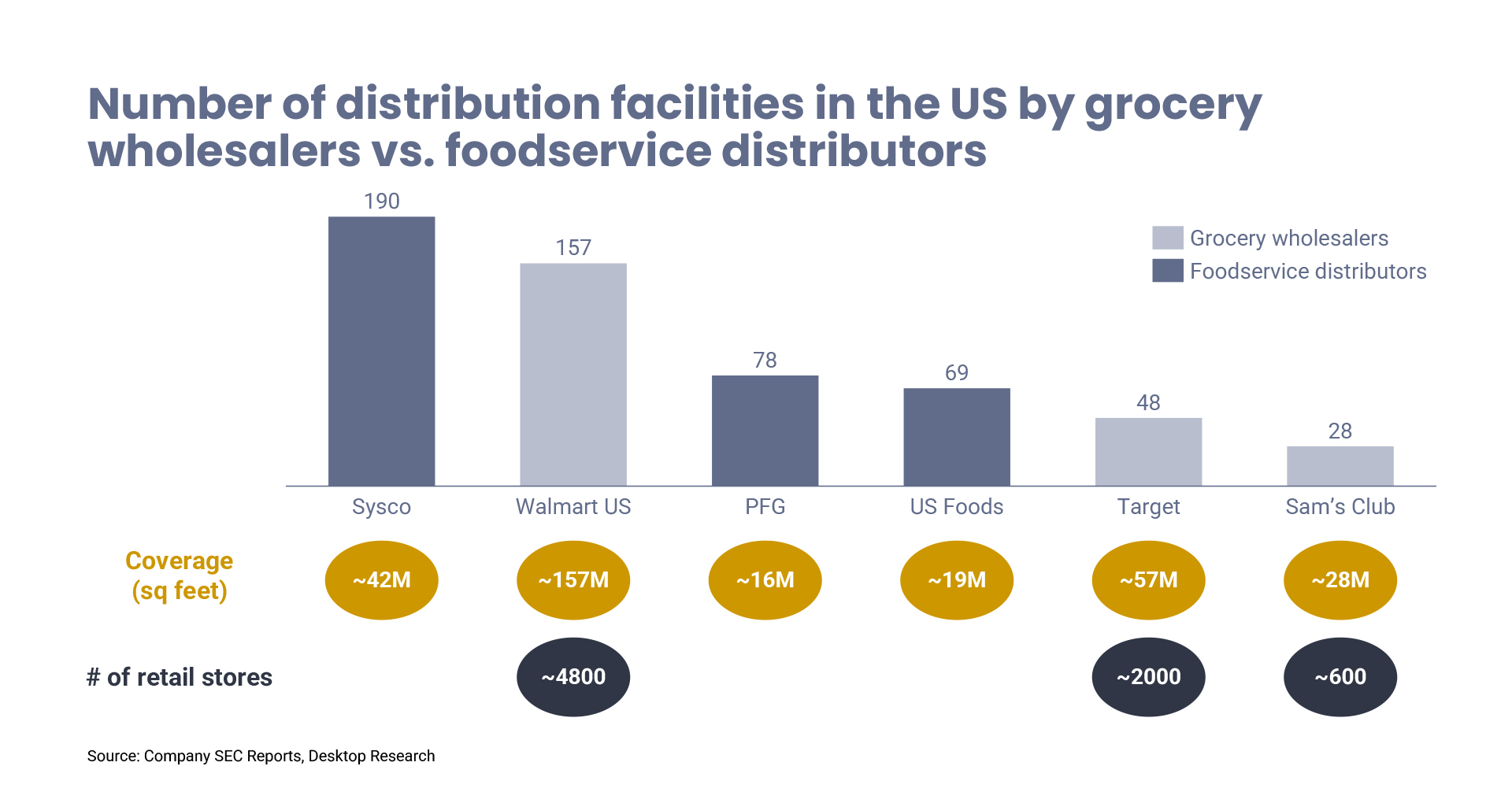

Large grocery wholesalers have an advantage of reaching the customer universe within the US market with their vast network due to the greater number of physical locations. They have a widespread presence across the country, with hundreds of locations in multiple states from distribution facilities to retail stores. This large network of physical locations allows grocery wholesalers to serve a wider range of customers. In addition, they may potentially have lower transportation costs and may deliver more frequently in small batches with the advantage of being closer to the customers. Therefore, they can be more competitive against incumbent foodservice distributors with their wide presence in the US.

Exhibit 5

For instance, Walmart’s and Sam’s Club logistics network and systems are among the most extensive and advanced in the US, including end-to-end cold chain distribution capabilities. Walmart has a vast network of nearly 4,800 stores (excluding Sam’s Club) located within 10 minutes of 90% of the US population. Also, Target’s stores are within 10 miles radius of around 75% of the US population. Companies such as Kroger, Target and Sam’s Club may use their physical store locations as distribution hubs for orders, which may make their cost of deliveries lower than incumbent foodservice distributors.

There are also some barriers to enter foodservice distribution for disruptors

Although sizeable and fragmented US foodservice distribution market makes it attractive for potential disruptors, there are certain consideration areas and barriers such as product & supply chain complexity and account relationship, which need to be considered.

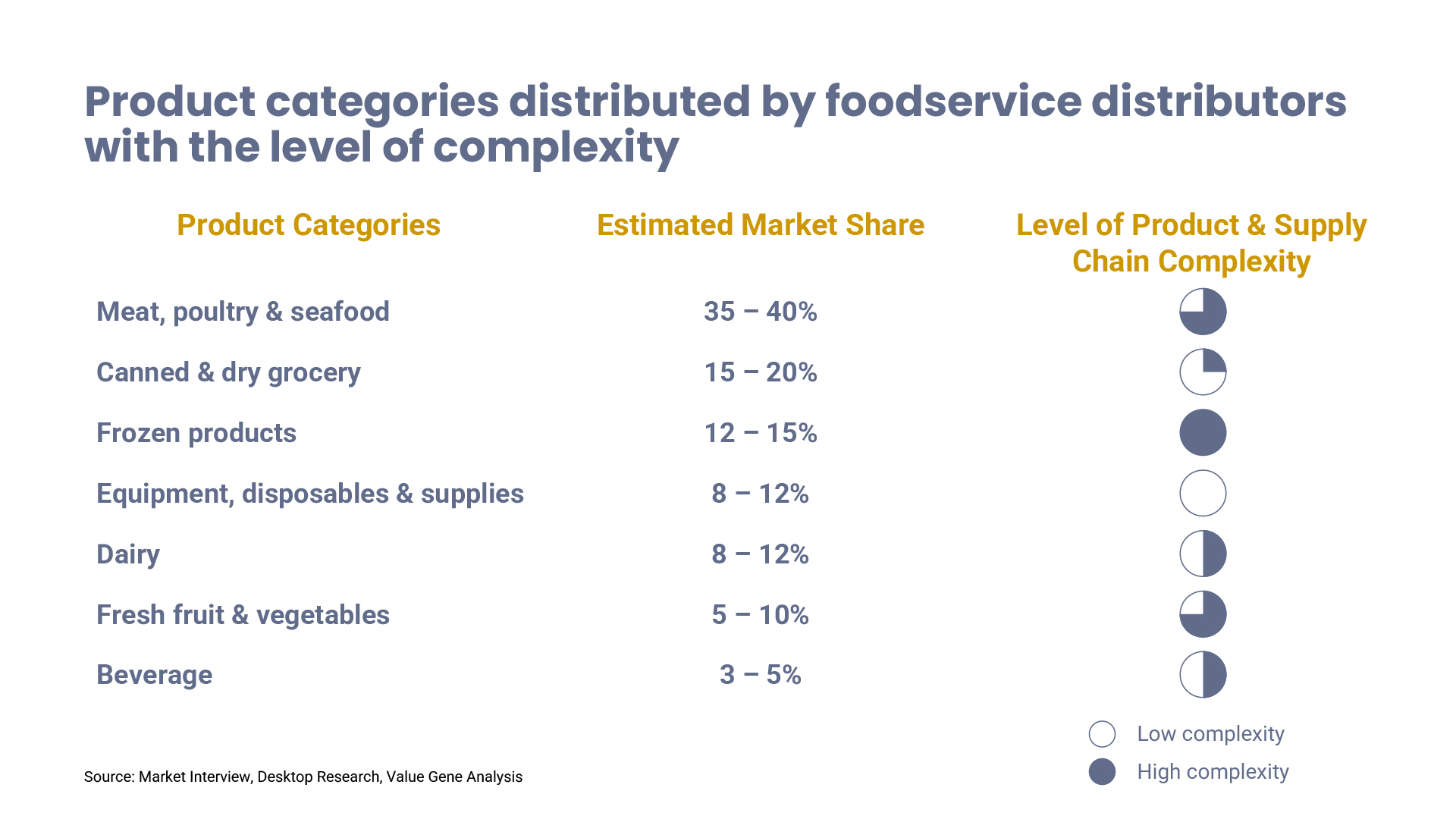

1. Product & supply chain complexities can be a barrier for e-commerce players, whereas large grocery wholesalers may deal with it with their existing infrastructure

The foodservice industry involves a wide range of products, many of which have specific storage and handling requirements, such as refrigeration or freezing. To ensure that cold chain distribution capabilities are in place, companies typically use a combination of refrigerated transportation, refrigerated warehouses and cold storage facilities, temperature-controlled packaging, monitoring, and tracking technologies. These elements require investments and can make it difficult, especially for e-commerce players to develop the necessary logistics and storage infrastructure to support product categories that need cold chain distribution. On the other hand, large grocery wholesalers already have end-to-end cold chain distribution capabilities which will be an opportunity for them.

Exhibit 6

In addition, it is important to note that around 65% of the total foodservice distribution market requires cold chain distribution capabilities for meat, poultry & seafood, frozen products, dairy, fresh fruit & vegetables, and beverages (in some cases), meaning that around 35% of the market is still unprotected for potential entries of players who do not have cold chain distribution capabilities.

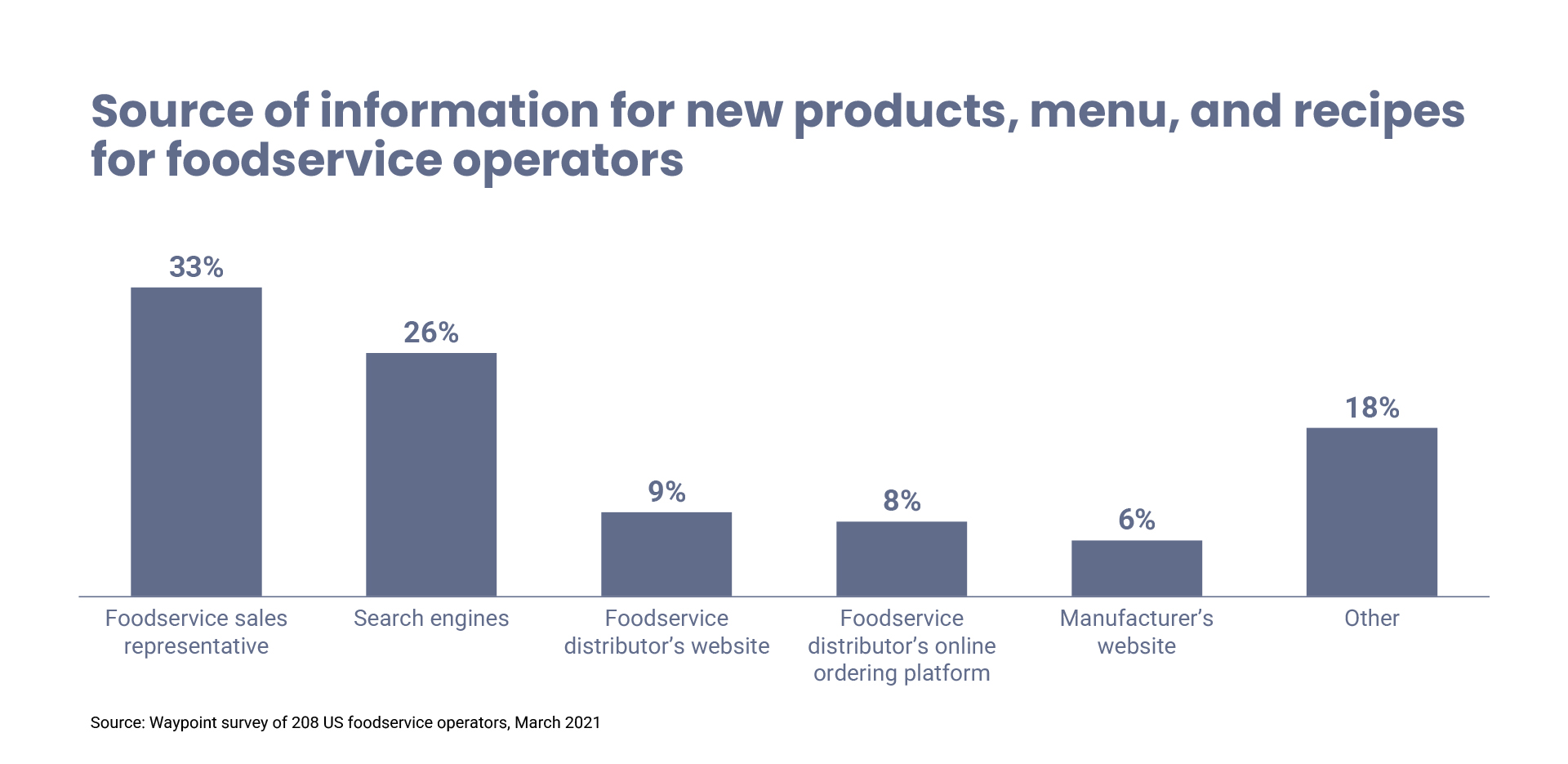

2. Account relationships could be both a barrier and an opportunity depending on customer groups

Many food service distributors have long-standing relationships with their customers, and these relationships are based on trust and personal interactions. The potential disruptors may find it difficult to establish similar relationships. However, new generation decision makers may be a target for them since they tend to be more open to digital platforms and some may prefer to purchase directly online. In a survey conducted among foodservice operators in the US reveals that around half of the foodservice operators say that digital platforms like search engines and online portals is their first choice of source of information for new products, menu concepts and recipes.

Exhibit 7

It is only a matter of time for the potential disruptors to enter the scene

Despite the barriers to entry, it is only a matter of time before the potential disruptors enter the foodservice distribution industry. Sizable grocery wholesalers with their vast network of distribution and e-commerce players, which have a proven track record of success in e-commerce, have the potential to be major disruptors in this market. They can be competitive in the market while offering a broader range of product categories and a better customer experience through more frequent deliveries. Potential disruptors’ vast logistical network, sophisticated technology and digital platforms may give them an advantage in the foodservice distribution market.

Grocery wholesalers may have an advantage over e-commerce players with their capability of cold chain distribution

Potential disruptors have different strengths and weaknesses that may set them apart in the industry. Although, e-commerce players like Amazon is their online platform. They can reach a large customer base through their website and mobile app, and they can easily expand their reach by offering faster and more frequent deliveries, grocery wholesalers have an advantage over e-commerce players since they have end to end cold chain distribution capability. This makes them more competitive in the market as they can store and transport perishable items without any investment requirement.

Incumbent foodservice distributors should act before it is late

To respond to the potential entry, incumbent foodservice distributors may take several actions:

1. Utilize digital & advanced analytics to better understand and serve foodservice operators: In today’s digital age, it’s important for foodservice distributors to adopt digital and advanced analytics & AI to increase their customer reach and improve customer experience. With evolving customer expectations, foodservice distributors should bring a holistic perspective and develop their Analytics and AI transformation strategy considering all steps across the value chain from procurement to customer delivery & aftersales. This can include pricing & promotion optimization, customer segmentation, inventory optimization along with order entry / management / tracking platforms for customers, improvement of their own e-commerce capabilities etc. Therefore, they can be ready to compete what potential disruptors may offer.

2. Improve salesforce effectiveness: Foodservice distributors work with large sales force in the field and efficiency & effectiveness of sales force is highly critical to be competitive against potential disruptors especially to e-commerce players that sell directly through online platforms with lower SG&A cost. For instance, US Foods have around 4,000 sales associates and a leading sales force. Potential disruptors would not have large sales teams and can potentially save money on these costs.

As a part of sales force effectiveness, foodservice distributors may reconsider customer segmentation and targeting, sales force activity planning to reduce travel times and potential increase in facetime with customers

3. Diversify product offerings: To differentiate themselves from e-commerce players and large grocery wholesalers, foodservice distributors can offer a range of exclusive, high-quality products that are not readily available through those channels. By offering unique and specialty items, foodservice distributors can differentiate themselves and appeal to customers who are looking for something different. For example, a foodservice distributor might focus on sourcing organic or locally sourced products or offer a wider range of ethnic cuisines. This strategy allows foodservice distributors to tap into niche markets and build a loyal customer base.

4. Provide value-added services: Another strategy that foodservice distributors can use is to offer value-added services such as offering personalized support, being responsive to customer needs, training, and consultation to help customers optimize their operations. For example, a foodservice distributor might offer training and consultation on food safety, kitchen design, menu planning etc. Another way of having a value-added service also could be instant or more frequent deliveries to the customers. For instance, US Foods Pronto service let restaurant operators receive smaller orders more frequently. By providing customers with any valuable services and expertise, foodservice distributors can establish stronger relationships and increase customer loyalty.

In summary, two major potential disruptors; e-commerce players and grocery wholesalers may present a threat for incumbent foodservice distributors. Although potential disruptors have some advantageous in B2B distribution, foodservice distribution market has some barriers to enter for them. It is time for incumbent foodservice distributors to react to stay competitive in the future. This will not be a straightforward process and it will require transformational change by (1) utilizing digital and advanced analytics, (2) improving sales force effectiveness, (3) diversifying product offerings and (4) providing value added services.