Food companies may find themselves at a critical juncture, as overall calorie intake of US population is expected to be reduced by ~2.5% with the surge of GLP-1 drugs over the next decade. The evolving landscape may require a proactive response from industry stakeholders.

By Okan Akgun and Cagatay Kaboglu

The emergence of GLP-1 drugs, initially designed to assist type 2 diabetes patients, has unveiled an unexpected boon — these medications showcase efficacy in appetite suppression and weight loss. This revelation has ignited a surge in demand, outpacing current supply capabilities. Our projections indicate that, over the next ten years, approximately 66 million individuals in the US alone will rely on these drugs. While this shift influences dietary habits, we estimate an overall 2.5% decline in the calorie intake of the US population by 2035, particularly in high-fat and sugary food consumption.

This changing landscape may pose challenges for food companies specializing in such products. The advent of these drugs in oral form, coupled with potential price decreases spurred by new market entrants, suggests heightened potential for widespread adoption. In this evolving scenario, certain food categories may witness a ~10% decline in volume.

To adapt to this shifting landscape, stakeholders across the food industry spectrum — including food ingredients manufacturers, distributors, packaged food and beverage manufacturers, and food retailers — should consider a strategic review of their portfolios. This proactive assessment is crucial to identifying and addressing potential risks associated with changing market dynamics.

GLP-1 Agonists: Catalysts of Change in Dietary Habits

GLP-1 agonists, originally designed as therapeutic agents for managing type 2 diabetes, have emerged as pivotal influencers in the landscape of weight management. Glucagon-like peptide-1 (GLP-1) is a hormone naturally produced in the gut, playing a key role in glucose metabolism. Recognizing its potential beyond diabetes treatment, researchers explored its impact on appetite regulation and weight loss.

These agonists function by mimicking the effects of the GLP-1 hormone, enhancing its activity. Notably, they contribute to increased feelings of satiety, reduced appetite, and a slower rate of gastric emptying. As a consequence, individuals using GLP-1 agonists experience a significant decrease in overall food intake.

The impact on dietary habits unfolds in two essential ways. Firstly, there is a diminished desire for excessive calorie intake, particularly from high-fat and sugary foods. Users often report a natural inclination towards healthier food choices. Secondly, the slower gastric emptying induced by these drugs influences the overall frequency of eating, promoting a more controlled and mindful approach to meals.

There are currently two FDA-approved GLP-1 agonists in the market for weight management. Novo Nordisk’s Wegovy was the first to receive FDA approval in June 2021, while Eli Lilly’s Zepbound obtained approval in November 2023. These drugs follow Novo Nordisk’s Ozempic and Eli Lilly’s Mounjaro, initially used to treat type 2 diabetes.

Administered through injection with a pen-type device, these drugs are designed for weekly usage on the same day, with doses ranging from 0.25 mg to 2.4 mg for Wegovy. Dosages are typically increased every 4 weeks until reaching the target dose of 2.4 mg weekly.

Wegovy comes at a steep price, reaching up to $1,349 for four weeks at 2.4 mg dosages, with a net cost (the amount payers spend) approximately at $700. Zepbound intensifies competition with a listed price of around $1,060, as reported by Eli Lilly.

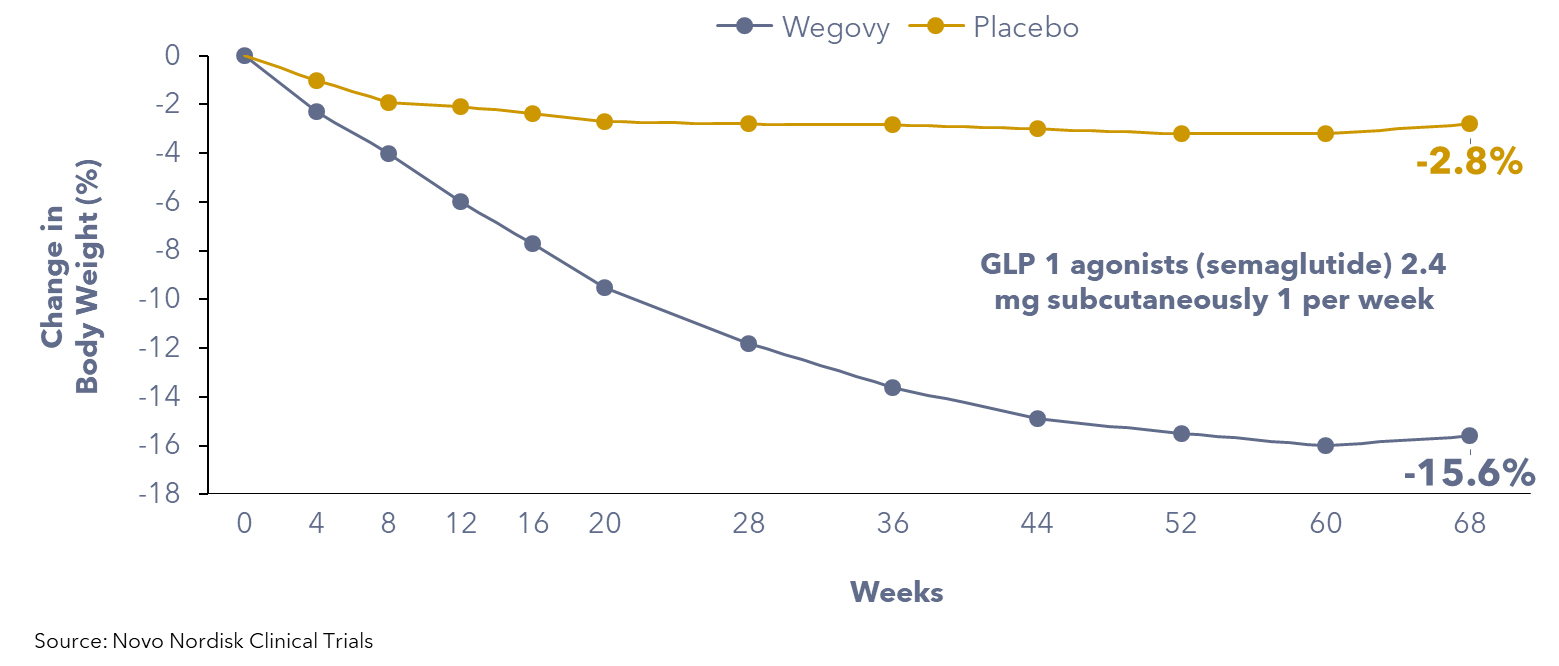

Dedicated trials in individuals with overweight and obesity, excluding type 2 diabetes, have confirmed the efficacy of GLP-1 agonists for weight loss in non-diabetic populations. A clinical trial funded by Novo Nordisk among ~2,000 individuals revealed that patients using anti-obesity medications may experience a significant reduction in body weight, typically ranging from 10% to 20% within 6 to 12 months. In contrast, patients on a placebo exhibited an average weight loss equivalent to 2.5% of their initial body weight.

Figure 1: Patients using GLP-1 agonists weight loss compared to placebo group

In addition to their weight management benefits, GLP-1 agonists also reduce the risk of heart attacks by 20%, as indicated by Novo Nordisk’s trial that studied more than 17,600 people aged above 45 with obesity who had cardiovascular disease, but not diabetes.

Despite their weight management benefits and the prevention of heart attacks, medicines in the same class as Novo Nordisk’s popular weight-loss therapy, Wegovy, may carry an increased risk of pancreatitis, intestinal blockage, and stomach paralysis compared to an older obesity drug, according to a report published in the JAMA medical journal.

Expected Growth of GLP-1 Adoption

The FDA’s approval of Wegovy and Zepbound marks a groundbreaking advancement in combating obesity. These medications are tailored for adult patients with a BMI exceeding 30 (classified as obese) and individuals with a BMI over 27 (considered overweight) who present at least one weight-related comorbid condition, such as hypertension, type 2 diabetes mellitus, or dyslipidemia. Additionally, pediatric patients aged 12 years and older, with an initial BMI at the 95th percentile or greater for age and sex, are eligible for these medications to address obesity.

In 2021, data from the CDC’s Behavioral Risk Factor Surveillance System (BRFSS) showed that about 140 million people in the US had a BMI greater than 27. Among them, roughly 123 million individuals, or 90%, had at least one obesity-related health issue. Additionally, among 12 to 17-year-old children, 1.3 million had a BMI higher than the 95th percentile. So, in summary, as of 2021, approximately 125 million Americans could potentially benefit from medications to manage weight.

Novo Nordisk reports that approximately 50 million people have access to Wegovy, with 12 million covered through Medicaid and 38 million through commercial insurance.

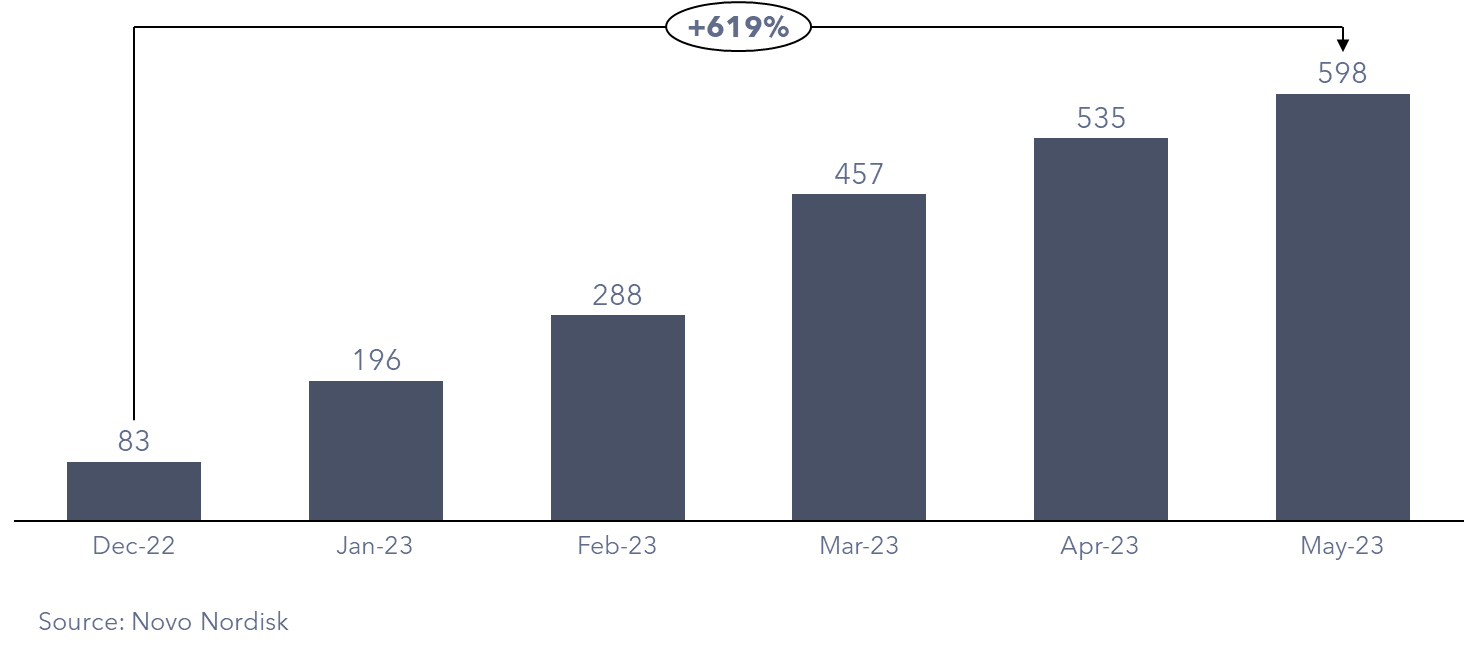

With this expansive reach, prescriptions for Wegovy have experienced a meteoric rise since receiving FDA approval in June 2021, surging to 600,000 as of May 2023. This remarkable figure represents a staggering sevenfold increase from December 2022. In response to the unprecedented demand, Novo Nordisk issued a statement acknowledging the strain on the supply chain and reduced the supply of Wegovy in the US.

Figure 2: Wegovy Prescriptions in the US (‘000)

Presently, impediments to further penetration include Novo Nordisk’s supply constraints, pricing considerations, and the limited coverage provided by health insurers.

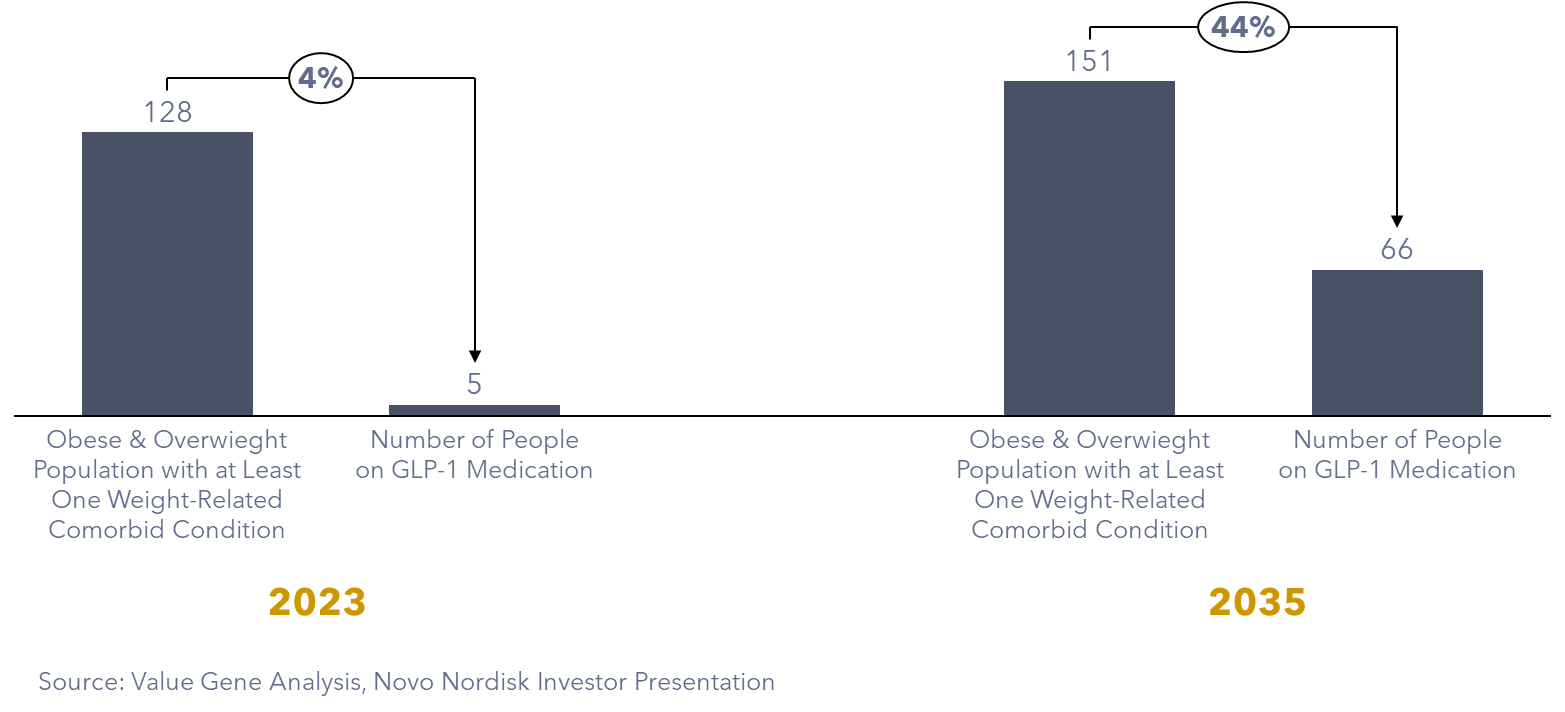

Our proprietary projection predicts a continued surge in GLP-1 adoption, with an estimated 66 million individuals in the US relying on GLP-1 medication by 2035. Moreover, ongoing trials exploring new health benefits may uncover additional patient groups poised to benefit from these innovative medications. Indications from trials showcasing positive results among individuals with cardiovascular diseases and chronic kidney problems.

Citing CDC data, we note that medical costs for adults grappling with obesity were $1,861 higher than those maintaining a healthy weight. We anticipate that a downward shift in prices, propelled by the entrance of new market players, an expanded scope of insurance coverage, and the well-established effectiveness of GLP-1 agonists in delivering additional health benefits, will serve as catalysts for overcoming current limitations.

It’s noteworthy that approximately 89% of individuals with type 2 diabetes fall into the overweight or obese category. In our comprehensive projections, we have included type 2 diabetes patients who will be treated with GLP-1 agonists, recognizing their potential as a valuable therapeutic option in this significant patient population.

Figure 3: Estimated number of individuals using GLP-1 agonists by 2035 in the US (Million People)

Impact on the Food Industry

The anticipated widespread adoption of GLP-1 agonists in the coming years suggests a potential shift in societal dietary habits. As more individuals incorporate these medications into their daily routine, the overall trend is projected to lean towards decreased consumption of calorie-dense, less nutritious foods. This, in turn, presents a significant consideration and opportunity for food companies, prompting a thoughtful reassessment of product portfolios and market strategies in response to changing consumer preferences.

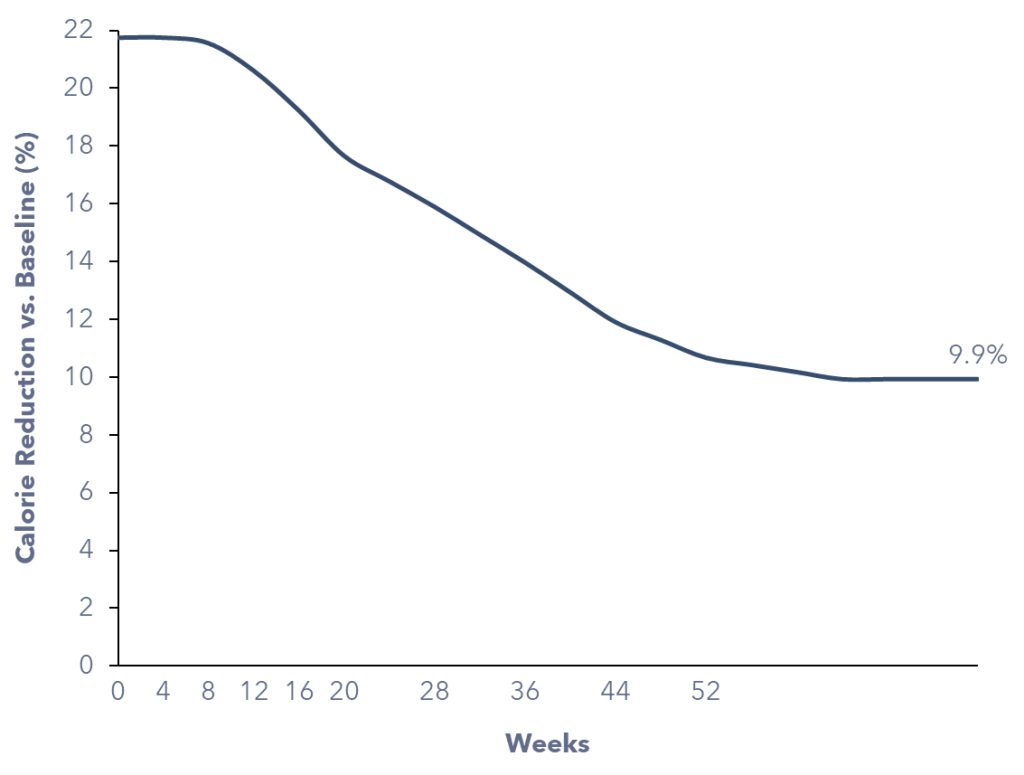

Our US calorie model predicts a potential 2.5% decrease in the overall calorie intake of the US population. In our proprietary calorie model, the total impact on calorie intake is assessed through two primary factors.

Firstly, a new GLP-1 patient would be consuming fewer calories than usual to achieve weight loss. We computed the required caloric deficit necessary for a 15.6% reduction in body weight over 68 weeks, considering the target patients’ average body characteristics, including sex, height, starting BMI, and body weight.

Secondly, GLP-1 patients will continue to consume fewer calories after achieving weight loss, as their active metabolic rate (AMR) decreases with reduced body weight. We calculated that, a GLP-1 patient would consume 9.9% fewer calories once they reach their target body weight, on average.

Overall, a new GLP-1 patient is expected to consume ~17% fewer calories on average during the first 68 weeks of initiating the medication. It’s essential to highlight that weight loss occurs at an accelerated rate in the initial six months, so as the caloric deficit. After 68 weeks, as the pace of body weight loss stabilizes, the individual would continue to consume 9.9% fewer calories due to the lower AMR.

Figure 4: Estimated Calorie Reduction of a GLP-1 Patient Over Time

Impact on the different segments of the food industry

This reduction could have a notable impact on stakeholders across the food industry spectrum — be it food ingredient manufacturers, distributors, packaged food and beverage manufacturers, or foodservice operators or retailers. Notably, one-third of this reduction is anticipated to be driven by food away from home (FAFH), primarily in restaurants and cafes, while we expect the remaining two-thirds to result from food at home (FAH), with grocery retailers playing a prominent role.

Ingredient manufacturers of sweeteners, artificial flavors, additives, and preservatives, as well as those producing bakery ingredients and chocolate, may encounter challenges with the growing use of GLP-1 drugs. Our model suggests a potential 5.2-5.4% decline in volume within these ingredient categories. Those specializing in sugary andchigh-calorie products could face difficulties as consumer preferences shift towards more natural and fresh ingredients.

Consumer packaged goods manufacturers with a product portfolio containing high levels of saturated fat, sugar, salt, and fried/greasy and oily foods are most at risk, as highlighted by Harvard Medical School as well as Morgan Stanley’s research survey involving ~300 participants taking the drugs. GLP-1 drugs, by reducing the desire for excessive calorie intake, especially from high-fat and sugary foods, may impact confectionery, carbonated/sugary drinks, baked goods, alcohol, and snacks manufacturers. We anticipate a decline in demand for carbonated/sugary drinks by ~5.5% and baked goods by 5.2%. Consumers on GLP-1 drugs tend to make healthier choices, leading to increased consumption of fruits & vegetables, weight loss–management foods, and poultry & fish.

Impact on foodservice operators and restaurants will be significant, as individuals using GLP-1 agonists are expected to prefer eating more at home than at restaurants. According to Morgan Stanley’s survey, over 70% of respondents indicated either a significant or moderate change in behaviors, including eating more at home, changing the types of food they buy at the grocery store or when eating out, and opting for smaller meals. Quick service restaurant chains and pizza restaurants could face risks unless they shift their portfolios. Foodservice operators are projected to drive almost one-third of the anticipated calorie intake drop, accounting for approximately ~0.85% of the overall calorie intake of the US population by 2035.

In grocery retailers, a diminishing appetite for snacks, confectionery, baked goods, alcohol, and carbonated drinks is poised to have a direct impact on sales. At-home consumption (FAH) is expected to contribute to nearly two-thirds of the projected decrease in calorie intake, accounting for approximately ~1.65% of the overall calorie intake of the US population in our base case scenario. In September 2023, Walmart’s President and CEO, John Furner, acknowledged that customers taking GLP-1 drugs were purchasing less food. This insight was derived from a robust anonymized analysis leveraging their 5,200 stores across the US operating pharmacy programs. They tracked purchasing changes over time among individuals using the drug and compared those habits to similar individuals not taking the drug. Furner also noted that it is still early to draw definitive conclusions about the appetite-suppressing drugs manufactured by Novo Nordisk and Eli Lilly.

A More Aggressive Scenario

As we delve into the potential future scenarios surrounding GLP-1 drugs, it is essential to factor in the dynamic landscape shaped by new entrants in the pharmaceutical arena. Recent announcements by Astra Zeneca exemplify a growing trend in pharma companies investing in GLP-1 drugs, signaling a shift towards a more accessible and diverse market.

Astra Zeneca’s licensing agreement with China’s Eccogene for an oral GLP-1 medicine presents a noteworthy development. The commitment to developing the “next generation” of pill-based treatments demonstrates a concerted effort to overcome the current limitations associated with injections. Notably, Astra Zeneca’s emphasis on a “much lower” production cost opens avenues for broader accessibility, potentially reaching a more extensive demographic. This diversification in drug formats may influence consumer acceptance and drive increased adoption.

Simultaneously, there is a compelling case for a shift in health insurance coverage for GLP-1 drugs. Presently, approximately 30% of health plans include coverage for these drugs. However, several factors could pave the way for a significant expansion in coverage:

- Proven Efficacy and Health Benefits: As the efficacy of GLP-1s in yielding substantial health benefits becomes more apparent, health insurers may recognize the long-term advantages of covering these medications.

- Decline in Prices and Launch of Oral Forms: The anticipated decline in prices, coupled with the introduction of oral forms, could make GLP-1 drugs more economically viable. This cost-effectiveness may encourage health insurers to reconsider and broaden their coverage.

- Health Authorities’ Recommendations for Overweight Individuals: Should health authorities advocate the use of GLP-1 drugs for overweight individuals, this could instigate a shift in coverage policies.

- Corporate Benefits and Employee Well-being: With GLP-1 drugs becoming sought-after corporate benefits, employers may increasingly include coverage in their health plans, further driving adoption.

Reimagining Adoption Projections: A Bold Projection

In envisioning a scenario where limiting factors are significantly mitigated, we dare to project an adoption rate to reach to ~74% of the population who are either obese or overweight with at least one obesity related comorbidity, estimated over 110 million. In this bold scenario, the potential impact on dietary habits is profound. We estimate a substantial 4.5% decline in total calorie intake in the US, with certain food categories facing volume declines as significant as 10%.

This exploration underscores the importance of continuously monitoring the pharmaceutical landscape and regulatory developments, as they can dynamically alter the trajectory of GLP-1 drug adoption and its subsequent impact on the food industry. As we brace for these potential shifts, it becomes increasingly crucial for food companies to not only assess risks based on current expectations but also remain vigilant to emerging scenarios that could reshape the industry landscape in unforeseen ways.

Navigating the Future: A Call to Action for Food Companies

In the wake of the impending rise of GLP-1 drugs and their profound impact on dietary habits, food companies face a critical juncture. The evolving landscape of consumer preferences, driven by the adoption of these weight management solutions, demands a proactive response from industry stakeholders. Alongside this transformation, it is crucial to recognize that certain food categories, which are already grappling with growth challenges, may encounter additional headwinds with the widespread adoption of GLP-1 drugs.

Strategic Evaluation of Portfolios

Food companies, regardless of their role in ingredient manufacturing, distribution, or packaged food and beverage production, must conduct a comprehensive assessment of their portfolios. The anticipated decline in high-calorie and sugary food consumption, influenced by GLP-1 agonists, necessitates a strategic reevaluation of existing product lines.

Identifying Areas of Impact

Consideration should be given to potential impacts on specific food categories, especially those traditionally associated with higher caloric content. Analyzing market dynamics and consumer trends will be instrumental in identifying areas of vulnerability and opportunity.

Promoting Innovation and Adaptation

As the landscape evolves, an opportunity for innovation and adaptation arises. Companies can explore the development of products aligning with emerging consumer preferences for healthier, lower-calorie options. Collaborative efforts with nutritionists and health experts may yield products that resonate with individuals increasingly conscious of their dietary choices.

Forward-Looking Strategic Planning

Preparing for this paradigm shift requires food companies to engage in forward-looking strategic planning. This involves not only adapting product offerings but also considering potential collaborations, acquisitions, or diversifications that align with the changing market dynamics.

Conclusion: A Proactive Approach to Thriving Amidst Change

In conclusion, the rise of GLP-1 drugs signifies a shift in the food industry. Embracing this change with a proactive approach allows companies to not only mitigate risks but also position themselves as leaders in catering to the evolving needs of health-conscious consumers. The call to action is clear: assess, adapt, and innovate to thrive in the era of changing dietary habits propelled by the growing influence of GLP-1 drugs.