The alternative grains market in the US is expected to grow more than traditional grains. Pulses are the most promising growth area over the coming 5 years due to protein applications, especially pea protein. Consumers following certain diets, preferring products with certain claims, and seeking plant-based & sustainable products make the market attractive for companies to invest. Fragmented market structure also allows companies to gain a foothold in alternative grain space.

In the last decade, alternative grains are on the rise thanks to consumer dietary trends. Companies operating in milling industry and traditional grain business started to invest to seize the surging demand in the market and grow their businesses in adjacent areas. Search of alternative protein sources by plant-based diet followers, ancient grains preferred by gluten free diet followers and oat used in dairy applications are expected to drive the growth in the market. The fragmented market structure still offers investment opportunities for milling operators.

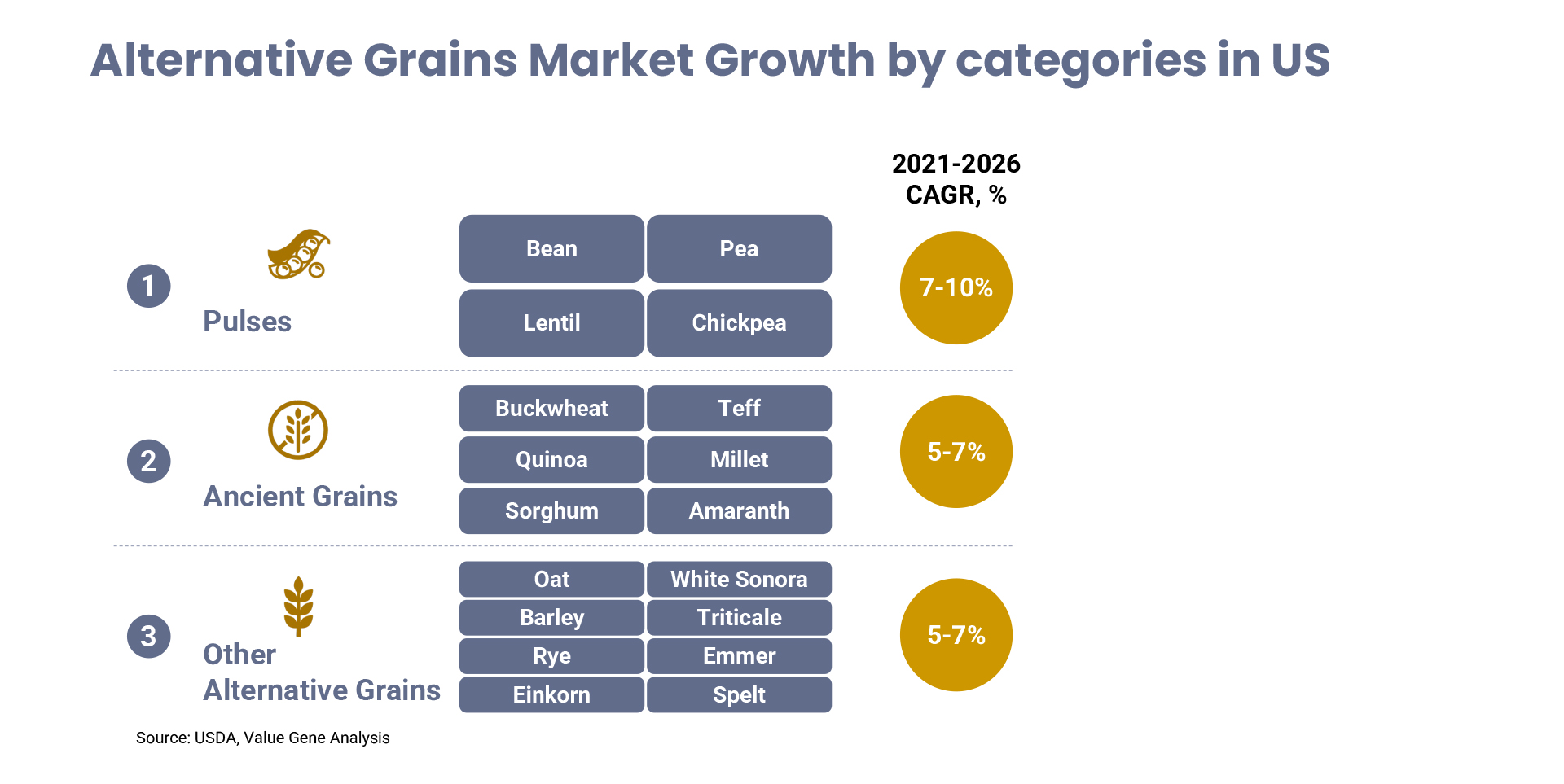

For thousands of years, traditional grains such as wheat, rice, corn, and barley have played a vital role in human nutrition. They are a rich source of carbohydrates, fiber, vitamins, and minerals, making them an essential part of a balanced diet. From ancient civilizations to modern times, they have been a staple food for people all over the world. Recently, alternative grains, including pulses and their protein applications, ancient grains such as quinoa, buckwheat, amaranth, sorghum, teff etc. are experiencing a surge in demand. The market is sizable and expected to grow at a CAGR of ~2-3% depending on the categories. Although Asia and Africa are the largest markets for both production and consumption, growth is mainly driven by North America, particularly by the US. In the US, the alternative grains market is estimated at around ~5 billion USD and expected to grow >5% per annum, which makes the US alternative grains market attractive for companies. Growth in the US is mainly fueled by consumer dietary trends.

Consumer Dietary Trends:

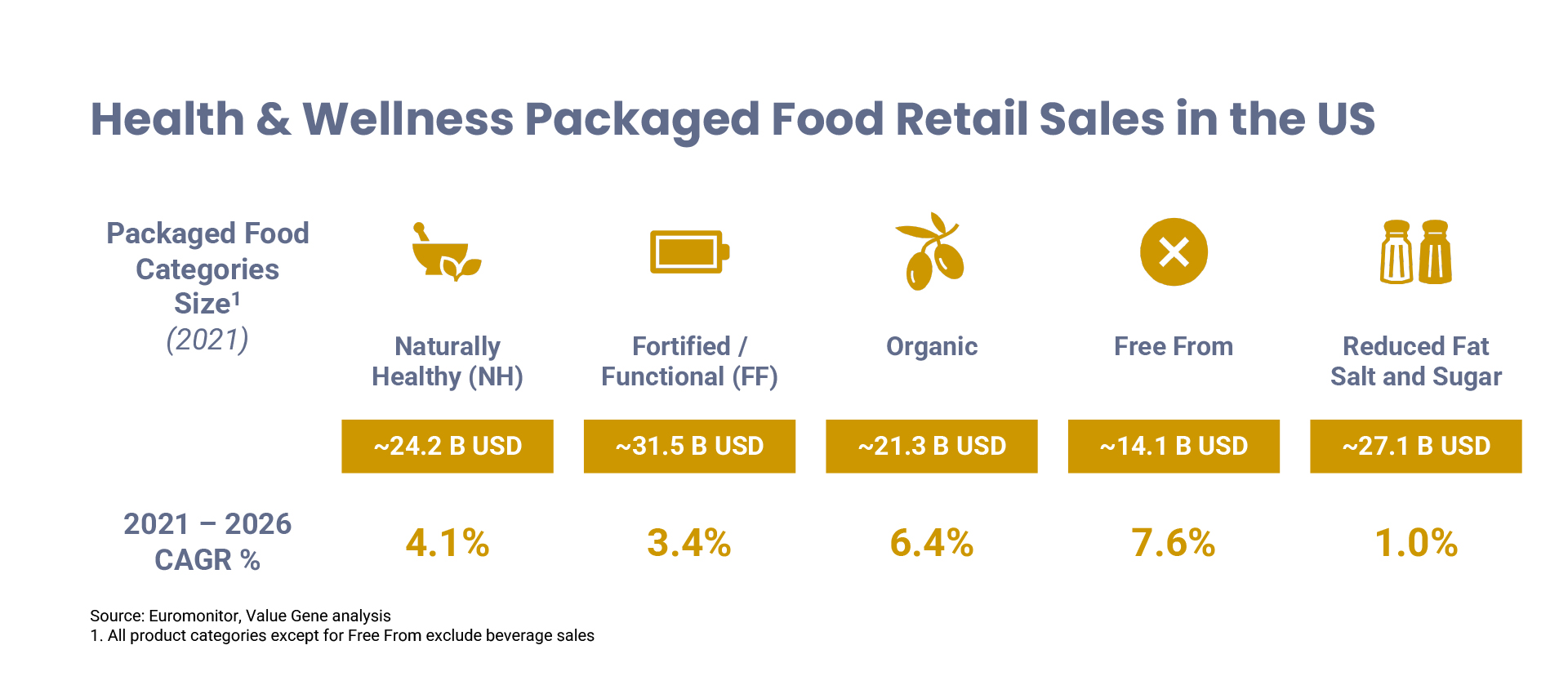

- Half of the adults in the US are watching a diet such as high protein / low carb, plant based / plant centric, calorie based / reduced sugar, allergen free etc. due to various reasons

- Plant based / plant centric diet has been growing among US population with an estimated ~30 million diet followers

- An estimated 3 million American adults suffer from Celiac disease, while 18 million have gluten sensitivity of some degree

- There are 100+ Million US consumers preferring products with certain claims such as natural flavors and colors, non-GMOs, high fiber and high protein etc.

- Products with Organic and Free From claims are expected to grow above market average

- Consumers are seeking green, natural, and “no nasties” products; they prefer to buy ethically sourced and sustainable products

Exhibit 1

These trends will lead to an increase in consumption of different alternative grains in the US over the next 5 years.

Exhibit 2

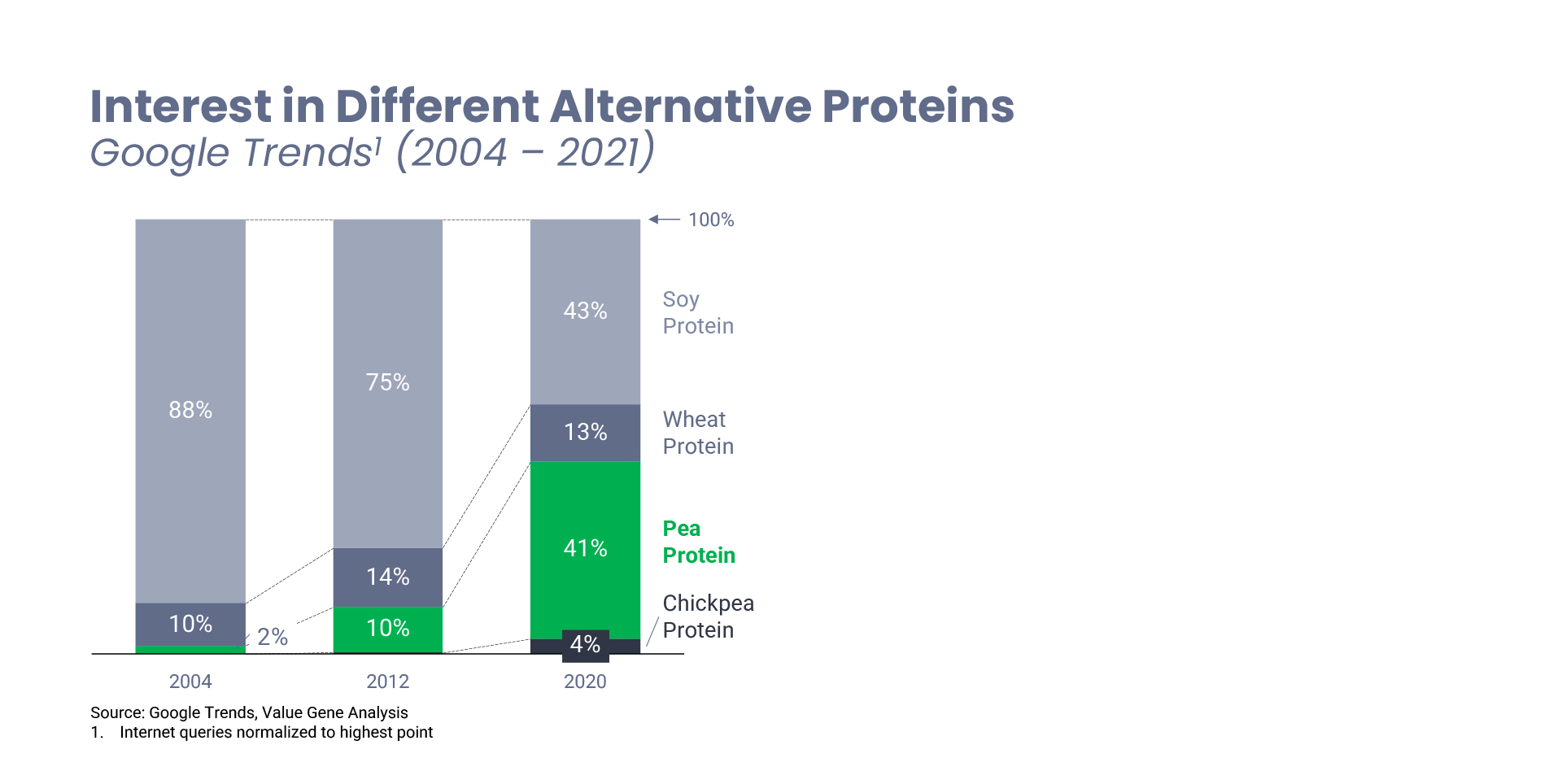

Pea protein is expected to outpace other plant-based proteins

Within Alternative Grains space, pulses are the most prominent category thanks to increasing demand for pulse protein applications. Over the last decade, plant-based protein market has gained popularity and strong demand over animal-based protein sources due to health-conscious flexitarians choosing plant-based options over animal proteins, consumers’ sustainability concerns, and the rise in snacking occasions and meal replacements. In the supply side, there is also a great R&D focus to improve taste, texture, and functionality of plant-based protein products. With these improvements, products with plant proteins now have more improved access in foodservice (e.g. plant based burgers by Beyond Meat and Impossible Meat) and within meat-section / dairy section of grocery stores.

Although soy protein leads the market with a share of >80% in plant-based protein market and is expected to be the primary choice being the most versatile and inexpensive source along with its functionality, growth in pea protein is expected to outpace soy and other mature categories; owing to natural and health positioning of pea, which drives the higher consumer acceptance. Google trends analysis also shows that interest in soy protein has been in decline while it has been growing strongly for pea protein.

Exhibit 3

Over the past few years, with increasing demand for non-soy alternatives, demand for pea protein piled up and companies experienced shortages in processing capacity. Pea protein processors such as Roquette, Cargill and ADM planned to increase their capacities: Roquette announced a $400 million project in Manitoba, Canada, while Cargill and Puris jointly invested 100 million USD in Minnesota, US and Archer Daniels Midland (ADM) builds its own facility in North Dakota, US. With relatively small size in plant protein market and expected double digit growth, investments to pea protein will be accelerated in the coming years.

Ancient grains continue to be preferred in gluten-free diets

On the other hand, ancient grains have been becoming increasingly popular as they are considered healthier and often more nutrient-dense than traditional grains. They are also naturally gluten free and are not refined or minimally processed. This makes them preferred by gluten free diet followers and consumers seeking non-GMO & naturally healthy claims. Buckwheat, Quinoa and Sorghum are the largest categories representing the majority of ancient grains market. Quinoa is considered a superfood as it contains complete protein structure covering all the essential amino acids, high fiber, antioxidants & minerals. With its nutritional profile, quinoa is leading the retail market as an ingredient in products including ancient grains. “Pasta, rice, dry grains” and “cereal & granola” are the two largest end use as an ingredient for buckwheat and quinoa.

Oat becomes an important source in dairy applications

Last but not least, another important alternative grains is oats. Beverage applications, especially usage for dairy alternatives, drive the growth in the market. Thanks to its creamy texture and a mild, neutral flavor and ability to create high quality micro foam, oat is well-suited for use in a variety of beverages, mostly in oat milk, which can be used as a substitute for cow’s milk in coffee shops. With the sales of oat milk skyrocketed in the recent years, companies such as Chobani, Planet Oat invested and launched their own oat milks to capture the potential ignited by Oatly, Swedish food company.

It is a fragmented market

To address this surging demand and seize the opportunity in the market, many companies have been investing in alternative grain space and making the market highly fragmented. There are more than 50 companies operating in this space and can be grouped into two. On one side, there are companies with wide category portfolio, offering traditional wheat & corn and investing in alternative grains as a growth venue. On the other side, there are companies purely focusing on alternative grains and do not offer any traditional grains. There is no winner right now and the competitive landscape will continue to evolve in the next years. The companies that are willing to take a strong position in this market should have a clear growth plan in order to be ready for the increasing competition in the market.

In summary, the alternative grains market in the US is expected to grow more than traditional grains. Consumers following certain diets, preferring products with certain claims, and seeking plant-based & sustainable products make the market attractive for companies to invest. Pulses are the most promising growth area over the coming 5 years due to protein applications, especially for pea. Fragmented market structure allows companies to gain a foothold in alternative grain space.