The EU Deforestation Regulation poses a significant challenge to the European coffee industry, requiring a potential investment of a billion Euros in the supply chain – equivalent to 5% of EBITDA generated by European coffee firms. Managing the short-term implications of depleting non-compliant coffee stocks in major ports is feasible, but the long-term consequences demand a transformative shift and substantial supply chain costs. Addressing the question of who will bear these costs becomes crucial during the transition period.

By Okan Akgun, Cagatay Kaboglu, Ozan Ozaskinli and Nihan Siriklioglu

Global demand to coffee has been surging, with Europe being the largest consumer

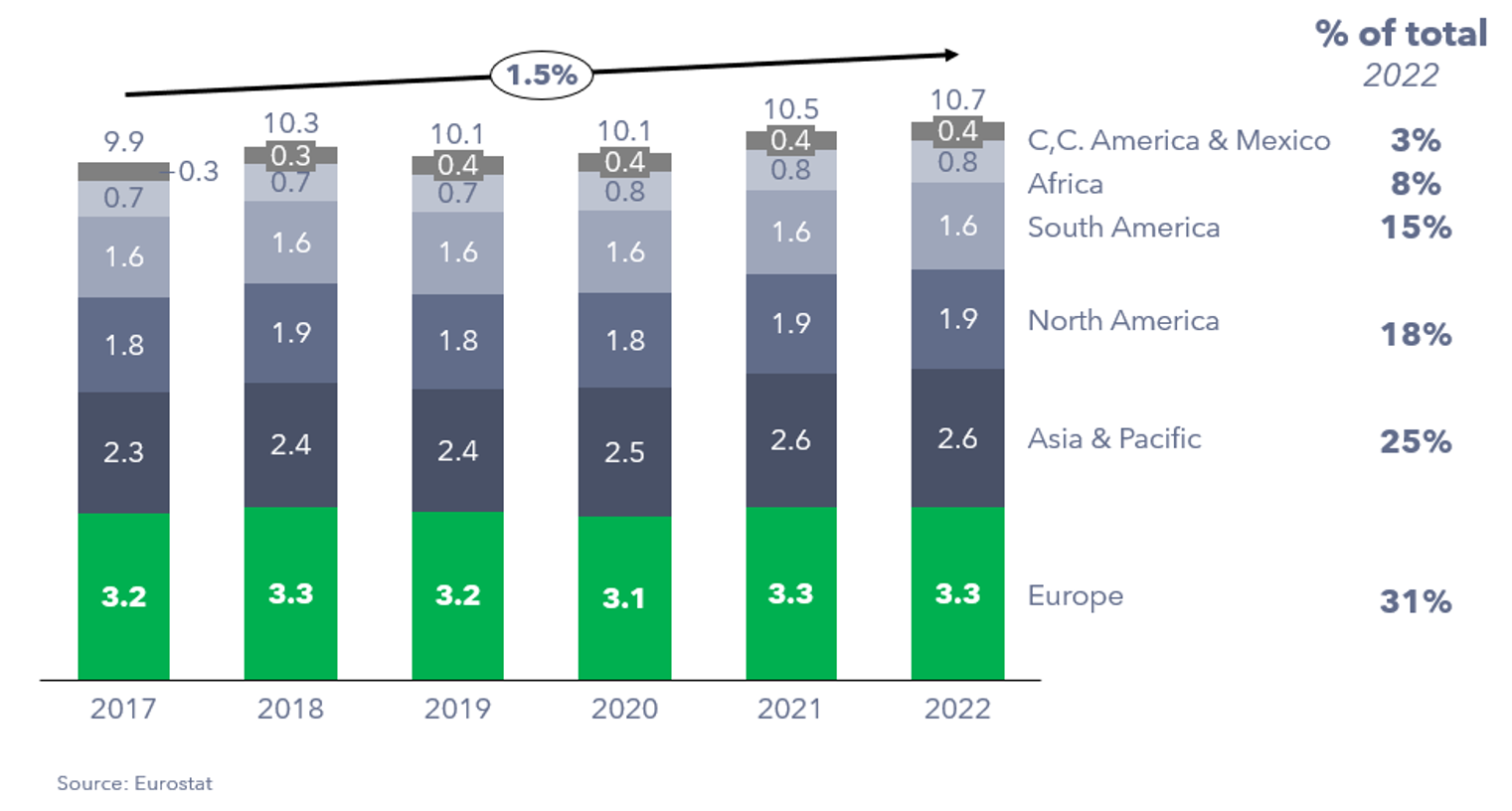

The global demand for coffee shows no signs of slowing down, with consumption growing by 1.5% per annum over the last 5 years. Europe retains its position as the world’s largest coffee market, consuming nearly one-third of the world’s coffee consumption.

Figure 1: Coffee consumption in the world by region (Million tonnes)

Deforestation and EU’s new regulation

In its simplest form, deforestation involves the removal of trees to expand land for agricultural and commercial activities, contributing to climate change, desertification, soil erosion, reduced crop yields, flooding, and increased greenhouse gas emissions. As the largest coffee consumer globally, Europe also holds the title of the largest coffee importer. Notably, 60% of its coffee imports originate from Brazil and Vietnam, where deforestation is prevalent. In a significant move in June 2023, Europe has taken decisive action to address deforestation associated with specific commodities, including coffee, by enacting legislation to restrict the import and sale of coffee linked to deforestation within the EU.

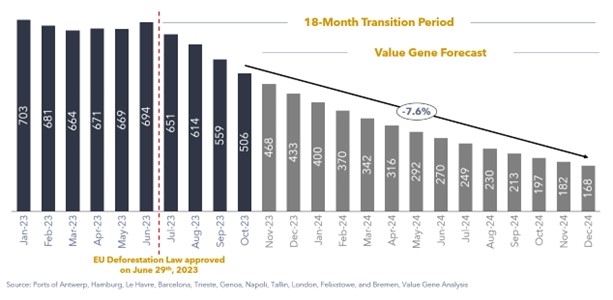

As per the new regulation, major coffee importers, including global coffee firms and traders, are mandated to undertake thorough due diligence across the value chain to verify that the imported coffee is free from recent deforestation (occurring after December 31, 2020). To facilitate a smooth transition, businesses have an 18-month preparation period, commencing from June 29, 2023, to December 31, 2024, before the new requirements come into full effect.

Impact on the EU coffee industry

The introduction of the new regulation ensures inevitable change for stakeholders throughout the EU coffee value chain, bringing forth diverse implications in both the short and long term.

Short term implications: Deplete non-compliant green coffee stocks

As of October 2023, just over 500,000 tonnes of green coffee, equivalent to 15-20% of Europe’s annual consumption, were stored in warehouses and major ports across the continent. Our calculations indicate a destocking pace of approximately 8% per month since June 2023. Projecting this pace forward, we estimate that EU warehouses may retain 170,000 tonnes of non-compliant green coffee stocks at the end of the transition period.

While this remaining stock is unlikely to face destruction, there is a potential for export outside the EU. Based on International Coffee Organization (ICO) composite indicator prices, the estimated value of the remaining stock in warehouses will be €600 million, representing 5% of annual consumption in Europe.

Major coffee firms operating in Europe, such as Nestle, JDE Peet’s, Melitta, Lavazza, and Starbucks, may need to redirect non-compliant coffee to their non-EU operations. Considering the 2022 export volume to non-EU destinations, approximately 430,000 tonnes, non-compliant stock could be directed to destinations with existing export relations, including the UK, Russia, Ukraine, the US, Switzerland, and Turkey.

The estimated shipment cost for export would be around €50-60 million, compared to the potential revenue contribution of €600 million. While the shipment cost represents 0.6% of the overall EBITDA generated by coffee companies operating in the EU, it is an expense that must be borne.

Figure 2: Green coffee stocked in the major European Ports (‘000 tonnes)

Long term implications: Transform coffee supply chain

In the long run, traceability is imperative to identify and monitor the coffee’s production location, substantiating the absence of deforestation in that specific area. Achieving this demands a substantial transformation of the supply chain, necessitating significant investment due to its inherent complexity. This complexity is fueled by three key elements:

To bring about a transformative shift in the coffee supply chain, various stakeholders must assume distinct responsibilities. Primary responsibility lies with global coffee firms, operators, and traders, given their pivotal role in demonstrating compliance with regulations. Consequently, a coordinated supply chain investment effort is essential through these key players.

The transformation of the supply chain hinges on three pillars:

- Technology Implementation: Enabling small farms to collect geolocation data, while coffee firms and traders track and store this information.

- Process Enhancement: Implementing processes to incentivize small farms, training stakeholders across the value chain, ensuring compliance with regulations, and fostering a culture of adherence.

- Governance Establishment: Orchestrating roles, assigning responsibilities, outlining conflict resolution mechanisms, and ensuring ethical, efficient operations aligned with overarching ecosystem objectives.

This transformation will have cost implications across the value chain. While each stakeholder will face different cost items, major coffee firms and traders may experience the most significant impact. Traceability constitutes a major portion of these costs, alongside other factors like chain of custody and audit costs, administration expenses, certification costs, farmer incentives, and training expenses, all of which necessitate careful consideration.

Figure 3: Additional cost items to each stakeholder along the coffee value chain

The primary investment focus lies in traceability, accounting for a range of 0.9% to 6% of annual sales for various agricultural products. Considering the intricacies of the coffee supply chain and drawing insights from comparable agricultural products like cocoa, our estimation suggests that dedicating approximately 4.3% – 6.0% of annual sales is warranted to trace coffee beans.

Identifying additional cost components, such as chain of custody and audit costs, administration expenses, certification costs, farmer incentives, and training expenses, we calculated the investment requirement as a percentage of sales, resulting in an approximate ratio of 1.7%.

Consequently, we estimate that the overall investment for supply chain traceability, including associated costs as a percentage of sales, is around 6-8%.

Given the valuation of green coffee consumption at €11 billion based on ICO composite indicator prices, our estimate places the projected investment at approximately a billion Euros. This cost represents nearly 5% of the EBITDA generated by coffee companies operating in Europe. Within this amount, recurring costs are estimated at €40 million.

Conclusion: Navigating Challenges

In conclusion, the long-term implications necessitate a supply chain transformation with a significant budget requirement, additional resources, coordination efforts, and change management activities, potentially spanning several years. This transformative change raises critical questions:

- Cost Allocation: Who will bear the investment cost and coordination efforts? Given farmers’ financial constraints, it’s nearly impossible for them to shoulder this burden. Coffee firms must take the lead in both cost and coordination. The key question is how much of this cost will be reflected in consumer-level coffee prices.

- Deadline Challenges: The transition period concludes on December 31, 2024, unless extended. Will the coffee supply chain be ready in the next 12 months? Transforming the complex coffee supply chain with multiple stakeholders and a fragmented farmer network is challenging. Coffee firms should be prepared for a demanding journey to meet the tight deadline. Failure to do so could result in compliant coffee supply issues in Europe, potentially leading to increased consumer-level coffee prices.

Coffee firms must meticulously plan this transformative change and take immediate action.