The feed industry stands at the threshold of a major shift, with insect-based sources emerging as a sustainable and efficient alternative to traditional protein and fat sources like soybean meal and fishmeal. Insects offer competitive economic advantages and superior nutritional benefits, supported by an increasingly favorable regulatory landscape. This sustainable approach to feed production has attracted significant investment in recent years, signaling a growing industry trend. Major soybean processors such as ADM, Cargill, and Bunge are actively investing in this burgeoning sector. The scale and speed of their investments are key indicators of how swiftly the industry might transition from traditional feed sources to these insect-based alternatives.

By Okan Akgun, Cagatay Kaboglu

There is a need for new sources of animal feed

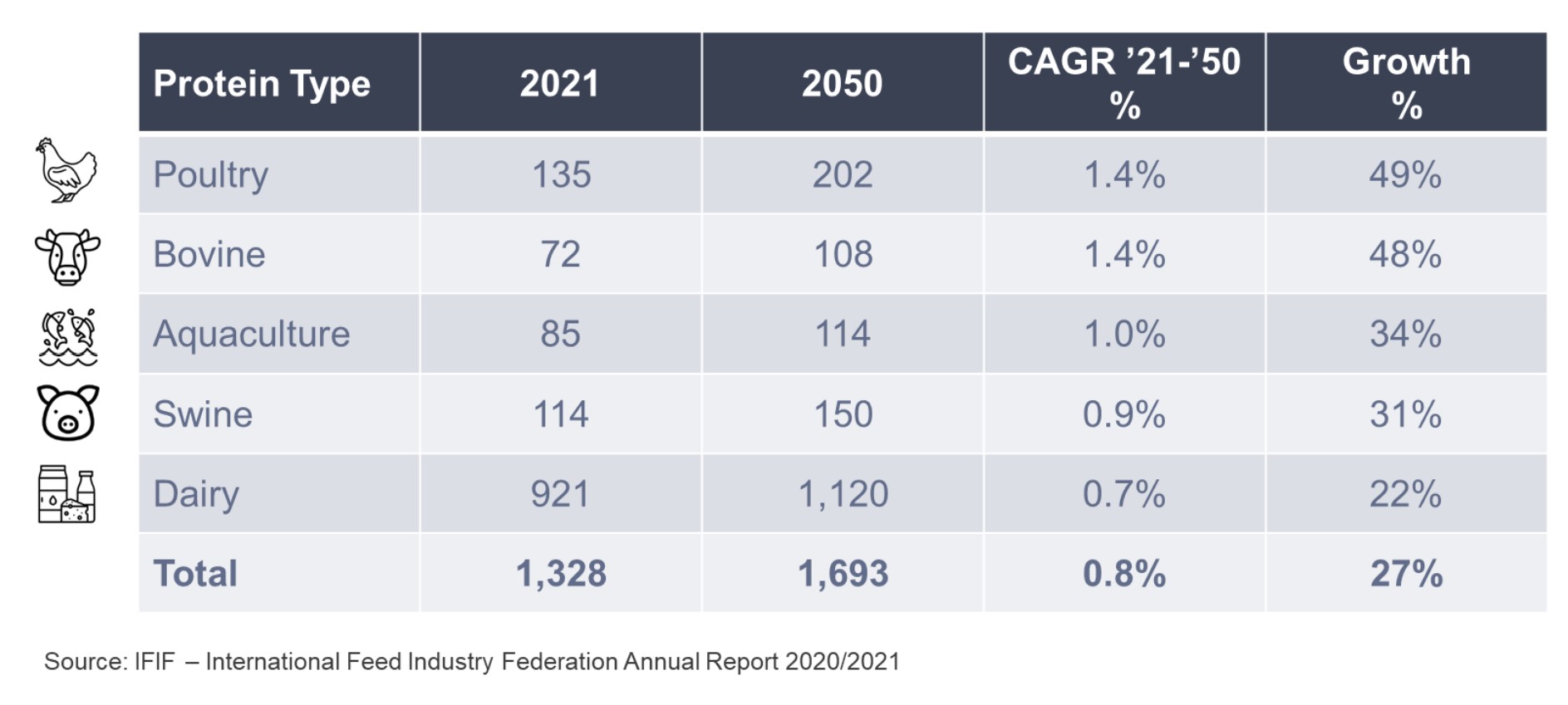

As the global population is projected to soar to 10 billion by 2050, he challenge of increasing current food production becomes more daunting. At the center of this challenge is meeting the rising demand for animal-source foods, which continue to be the primary source of protein in human diets. The International Feed Industry Federation (IFIF) forecasts a 27% surge in the production of animal-based protein by 2050 to address this global demand. This increase is not uniform across all categories: bovine (red meat) and poultry production are expected to experience the most significant growth, each anticipated to rise by approximately 50%. In contrast, production of swine and aquaculture products is projected to grow by about 30%. These figures underscore the evolving dynamics of the global food system in response to the burgeoning population.

Figure 1: World Animal Based Protein Production (Million Metric Ton)

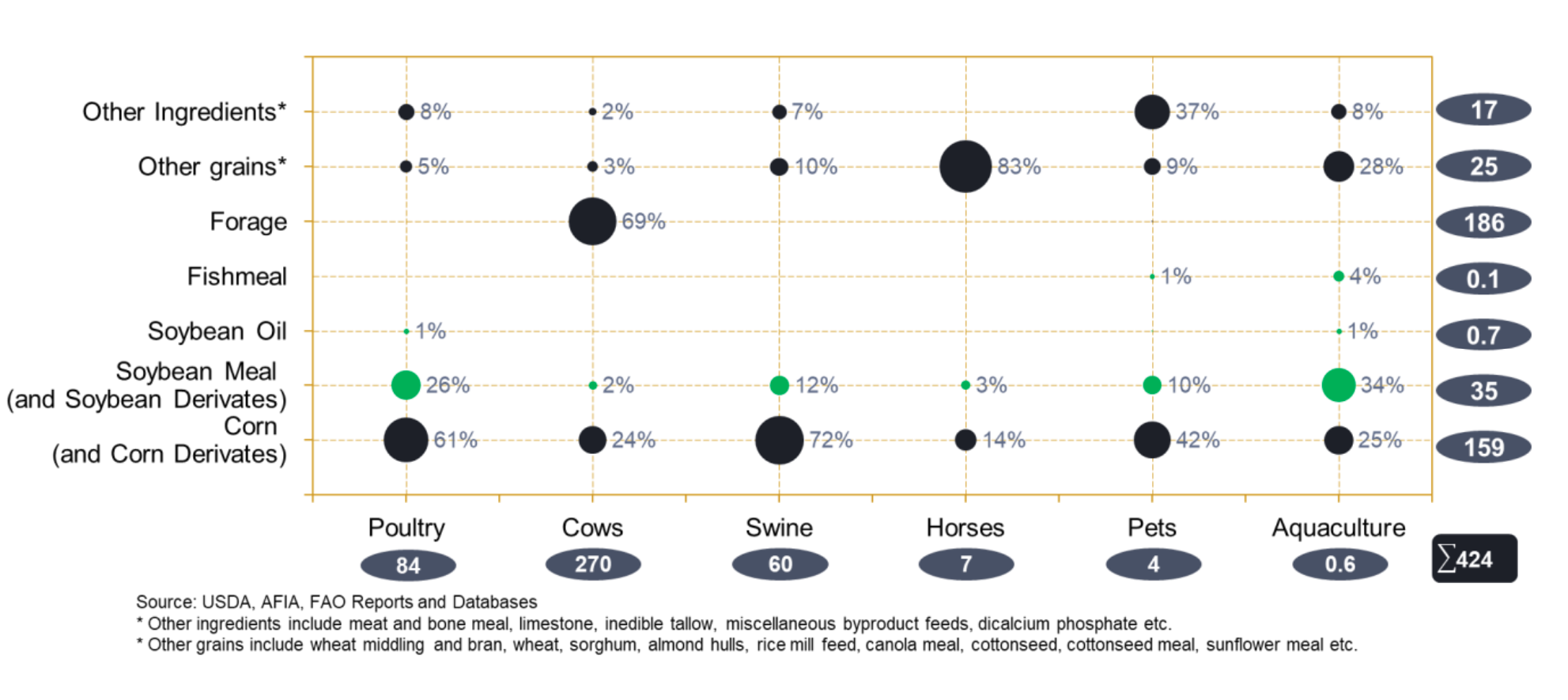

Since animal-based protein will continue to play a significant role in the next couple of decades for human diet, the methods of feeding animals become increasingly important. In today’s world, soybean and corn are the major components of animal feed. Soybean, with its high protein content and balanced amino acid profile, is a cost-efficient nutritional source for animals. Corn, rich in carbohydrates, particularly starch, provides a high energy yield. Consequently, 80% of global soybean disappearance and 60% of global corn disappearance are allocated for animal feed. Additionally, 10% of global fish production goes to fishmeal and is mainly used in aquaculture as a major protein source.

Since animal-based protein will continue to play a significant role in the next couple of decades for human diet, the methods of feeding animals become increasingly important. In today’s world, soybean and corn are the major components of animal feed. Soybean, with its high protein content and balanced amino acid profile, is a cost-efficient nutritional source for animals. Corn, rich in carbohydrates, particularly starch, provides a high energy yield. Consequently, 80% of global soybean disappearance and 60% of global corn disappearance are allocated for animal feed. Additionally, 10% of global fish production goes to fishmeal and is mainly used in aquaculture as a major protein source.

The projected growth in the feed industry until 2050 will bring challenges, considering land availability, irrigation requirements, deforestation, overfishing, climate change, and sustainability. Relying on crop-based protein sources and fishmeal to feed animals may not be a sustainable or affordable approach for the world. Therefore, there is a need to find new methods to address inefficiencies and reduce waste in all areas of animal-based protein production. In this context, using insects as an alternative protein source for animal feed emerges as a promising trend.

Insects emerge as an alternative protein source for feed in some animal types

Insects, a natural component of many animals’ diets, are gaining traction as a sustainable alternative protein source in animal feed. Currently, soybean meal has dominated as the primary protein source of various animal feeds, prized for its high protein concentration and balanced amino acid profile. Other sources like fishmeal (notably in pet food and aquaculture), canola meal, cottonseed meal, sunflower meal, and meat & bone meal also contribute as a protein source, while fish oil and soybean oil provide essential fatty acids and energy.

Figure 2: US Animal Feed Ingredients Market by Ingredient Type and Format (2023, Million Tonnes)

However, insect-based proteins and oils present a compelling alternative, particularly for poultry, swine, pet, and aquaculture species, owing to their efficient production and potential nutritional benefits. Moreover, insect byproduct frass emerges as a valuable resource for plant nutrition, demonstrating the versatile utility of insects in both animal feed and agriculture.

However, insect-based proteins and oils present a compelling alternative, particularly for poultry, swine, pet, and aquaculture species, owing to their efficient production and potential nutritional benefits. Moreover, insect byproduct frass emerges as a valuable resource for plant nutrition, demonstrating the versatile utility of insects in both animal feed and agriculture.

Black Soldier Fly Larvae, Mealworms and Crickets are the key species that could potentially be used for animal feed

Among the most promising species for animal feed are the black soldier fly, yellow mealworms, and crickets. Grasshoppers, silkworms, housefly larvae and termites are also viable, though to a lesser extent. The reasons that would be a potential substitute as protein source for animal feed are nutritional profile for optimal growth, short growth cycle, highly efficient feed conversion ratio, contribution to waste management and most importantly favorable economics of insect-based protein and oil. These key species demonstrate some differences as provided below:

- Black Soldier Fly Larvae (Hermetia illucens): BSFLs are gaining popularity as they are particularly efficient in converting organic waste such as fruits, vegetables, coffee grounds and even manure into protein and fat. Their feed conversion ratio is as low as 1.5:1 to 2:1. BSFL grows rapidly, reaching maturity in about 14 to 21 days under optimal conditions. They can be used in poultry, swine, aquaculture feed and pet food as an alternative source of protein and fat.

- Mealworms (Tenebrio molitor): Mealworms, which are the larval form of the mealworm beetle, are another increasingly popular option for animal feed and waste processing. They are commonly fed on grains, bran, cereal, or similar grain-based products. Their feed conversion ratio is usually higher than BSFL, meaning that they require more feed to produce the same amount of protein. Mealworm larvae reach maturity in several weeks to months. They are popular feed for poultry and used in aquaculture but not as extensively as BSFL. Their farming is relatively less complex compared to BSFL.

- Crickets (Various species): Crickets are another insect type farmed to use in animal feed. Yet, their farming is less common as compared to BSFL and mealworm since the complexity of rearing crickets is higher due to additional steps in the process such as manuring. Additionally, they require more space as overcrowding can lead to problems like cannibalism and rapid disease spread. Although their nutritional content is similar to mealworms and BSFL, their farming is less preferred.

Farming and processing insects for animal feed

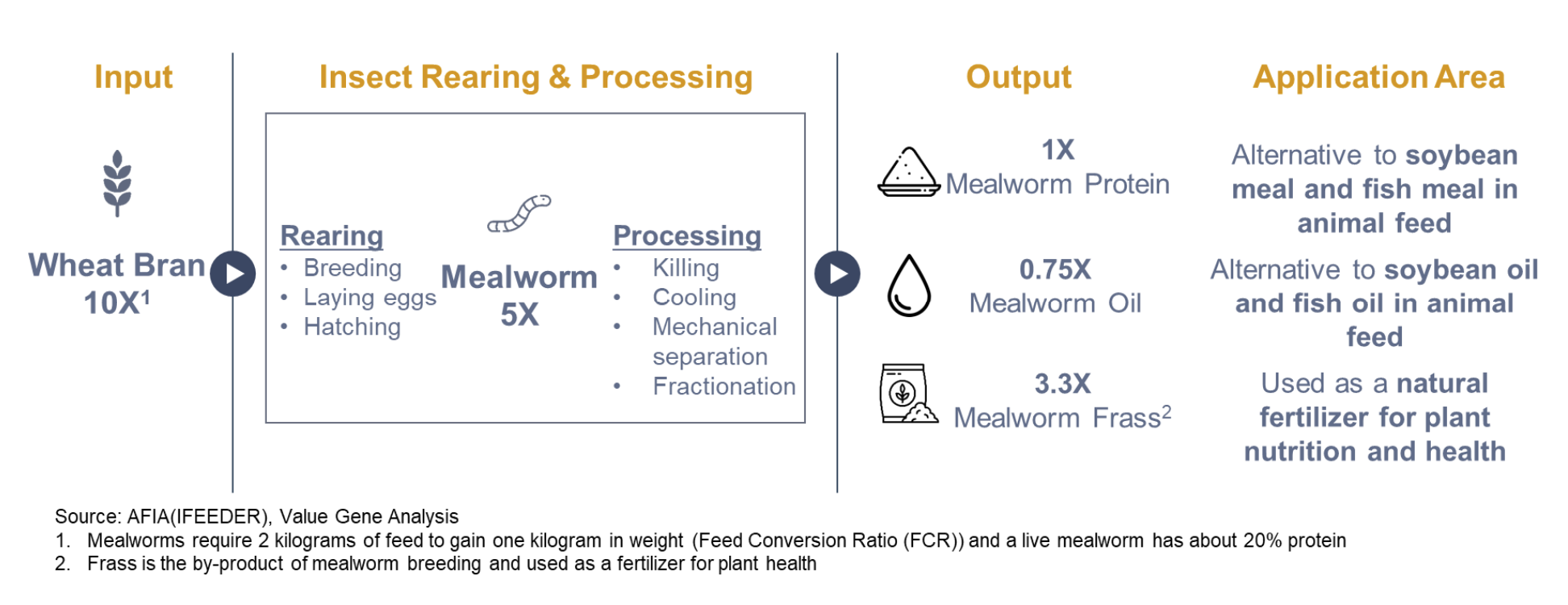

The process of extracting protein, oil, and frass from insects is a multifaceted process that efficiently utilizes different components of the insects. This process is not only sustainable but also maximizes the utilization of insect biomass, turning what would otherwise be waste into valuable resources. The efficiency and environmental benefits of this process make insect farming an attractive option in the context of sustainable agriculture and circular economy models.

Figure 3: Insect rearing and processing steps (Mealworm as an example)

Insect rearing and farming, particularly for species like the Black Soldier Fly, mealworms, or crickets, involves a series of steps designed to maximize the growth and productivity of the insects. The process starts with organic waste and then adult insects are bred to produce eggs. The eggs hatch into larvae, which are the primary stage used in waste processing. The larvae are fed a nutrient-rich diet to ensure rapid growth. The diet varies based on the insect species. For instance, Black Soldier Fly larvae are often fed food waste, while mealworms might be fed a grain-based diet. Once the larvae reach the desired size, they are harvested. Post-harvest, insects can be processed in various ways, such as drying, milling into a powder, or extracting oils. This process transforms them into a more usable form (i.e. protein and oil) for animal feed. The waste produced during insect farming (e.g., frass or insect manure) can also be used as a fertilizer, contributing to the sustainability of the process.

Insect based feed production is clearly an opportunity

There are 5 dimensions that will support the growth of insect-based protein & oil as animal feed and its byproducts (frass) as a fertilizer in the coming years.

Figure 4: Growth drivers of insect-based feed production

1. Mealworm protein can be competitive against existing protein sources for animal feed

1. Mealworm protein can be competitive against existing protein sources for animal feed

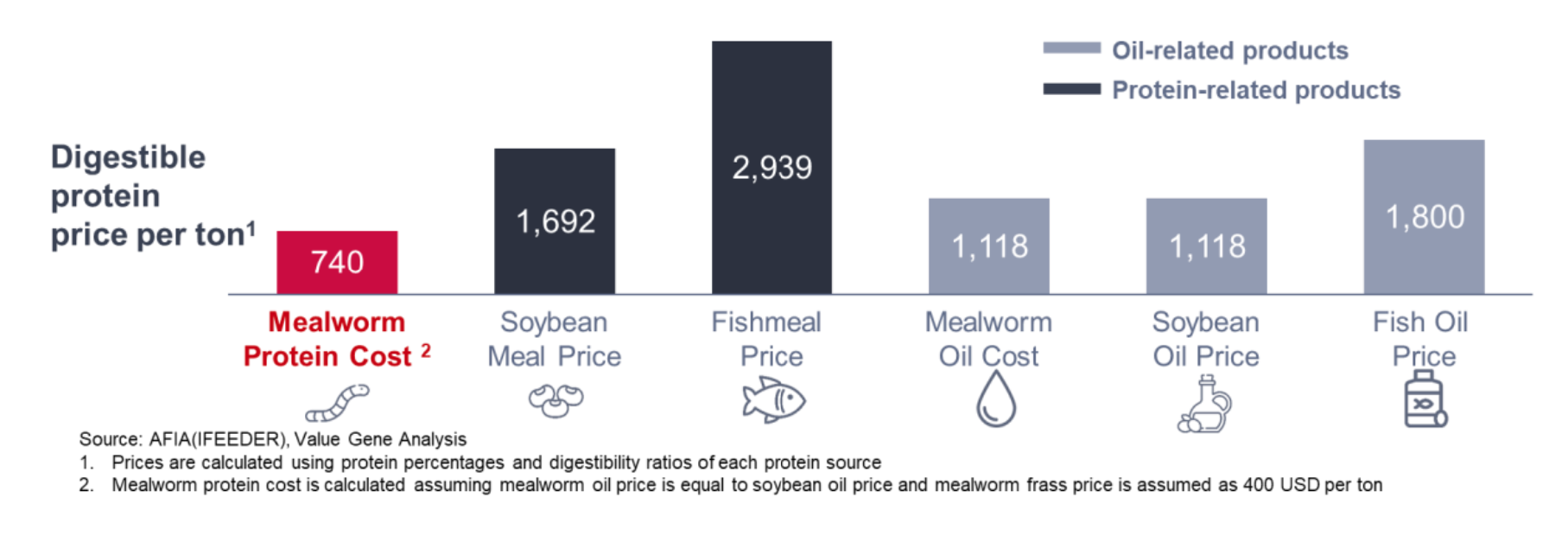

Animal feed manufacturers, operating in a competitive market with slim profit margins, are acutely very sensitive to feed component costs. Given their high production volumes, even minor ingredient cost variations significantly affect overall production expenses, impacting price-sensitive farmers with limited budgets. To assess mealworm protein’s compatibility with other sources, we analyzed its digestible protein cost per ton, factoring in potential revenues from selling mealworm oil and byproduct frass at soybean oil and fertilizer market prices. A >50% gross margin is possible for mealworm protein priced similarly to soybean meal.

Figure 5: Digestible Protein Cost / Price per ton of major Protein & Oil sources used in animal feed (2023, USD/ton)

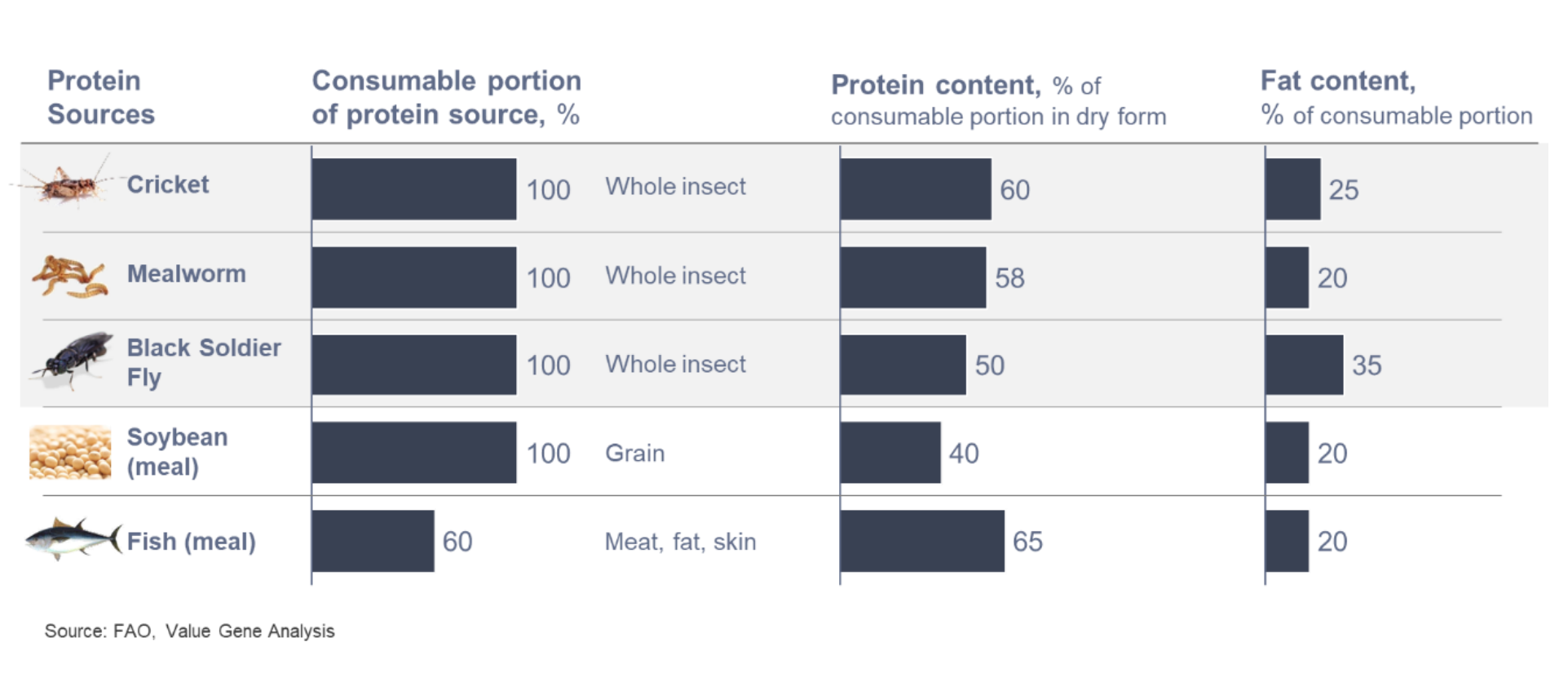

2. Nutritional values are comparable with existing ingredients

Balanced nutrition is essential for the health and optimal growth of farm animals and pets. Adequate protein, amino acid profile, fat content and digestibility should be key considerations in animal feed mix. Feed formulations aim to achieve these considerations at the lowest possible cost. Insects’ high-quality protein, beneficial fats, and micronutrients make it an excellent candidate as an ingredient in animal feed.

- Protein content: Insects are great protein sources, with protein percentages up to 60% of their dry weight, containing all essential amino acids. They are high in protein as compared to soybean meal and at par with fish meal. Additionally, soybean meal lacks certain amino acids such as methionine, which needs to be supplemented in feed formulations.

- Fat content and quality: The fat content in insects varies widely depending on the species but is generally slightly lower than fish oil. In terms of quality, insect fat is high in lauric acid, beneficial for immune responses in animals, whereas fish oil is rich in omega-3 fatty acids, especially EPA and DHA, which are crucial for animal health and not commonly found in plant-based oils.

Figure 6: Nutritional content of different protein sources in animal feed

3. Regulations are becoming in favor of using insect as animal feed

While promising, insect farming is still in the development phase and may require initial investment to scale up. Regulatory landscape is a crucial factor that will determine its widespread adoption in the animal feed industry. The regulatory landscape has been showing the initial signs of loosening in the last couple of years both in the EU and the US. Since September 2021, the possibilities to feed certain animals with insect-based proteins and oil are unlocked, thanks to the lifting of the EU ‘feed ban’ rules. The EU approved feeding insect-based protein to poultry and swine, a practice already allowed for farmed fish since 2017. Association of American Feed Control Officials (AAFCO) follows EU in terms of regulatory perspective.

4. Insects are sustainable and a circular solution in animal feed

Insects emerge as a more natural and sustainable alternative solution as compared to other protein sources such as soybean meal, fish meal for various compelling reasons.

a) Utilization of Organic Waste: Insects can be fed on organic waste streams such as food scraps or agricultural by-products such as wheat bran. This not only helps in waste reduction but also in creating protein sources without relying on additional agricultural or aquacultural inputs such as fish meal where supply is limited and often expensive due to overfishing.

b) Efficient Feed Conversion: Insects, such as crickets or mealworms, are highly efficient at converting feed into protein. They require less feed to produce the same amount of protein compared to cattle, pigs, or chickens. For example, BSFL and mealworms require twelve times less feed than cattle, four times less than sheep, and only half as much as pigs and broiler chickens This efficiency translates into less land and resources needed for feed ingredient production for crop-based protein sources.

c) Reduced Land and Water Use: Insect farming typically requires much less land than traditional agriculture and aquaculture. This not only helps in preserving natural habitats but also reduces the impact on land use changes like deforestation. Additionally, insects require far less water than traditional livestock or crop-based protein sources such as soybean.

d) Lower Greenhouse Gas Emissions: Insects generally produce significantly lower levels of greenhouse gases per unit of protein produced compared to traditional livestock or crop-based sources.

e) Biodiversity Impact: Insect farming is less disruptive to local biodiversity compared to large-scale soybean farming or fishmeal production, which often involve significant habitat alteration or overfishing.

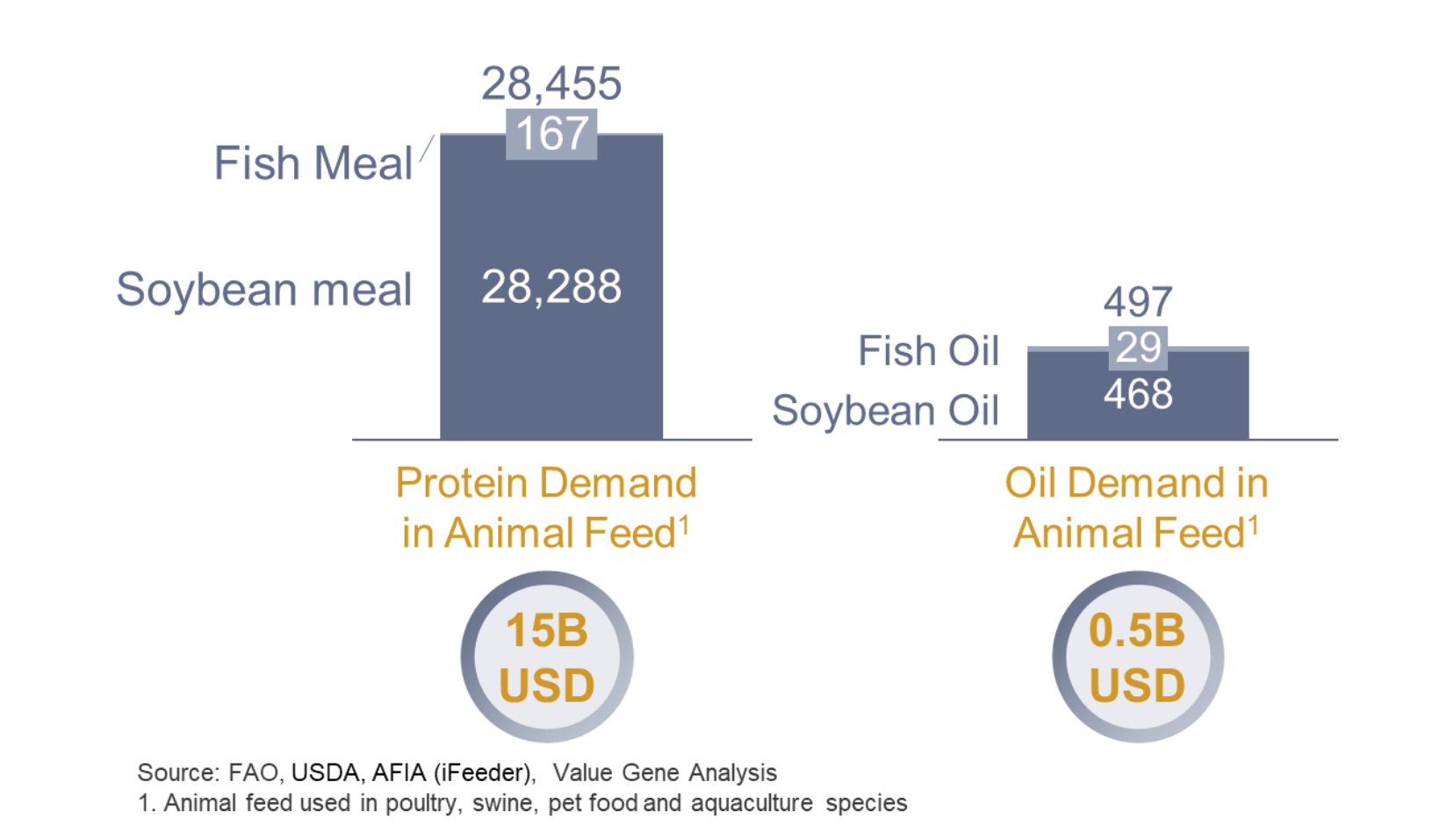

5. Huge market potential and large-scale investments to capture the potential

The addressable target market for animal feed, which includes groups such as poultry, swine, pet food, and aquaculture species, is significant, amounting to approximately 28 million tonnes annually and this market generates an estimated annual turnover of over $15 billion in the US alone. Assuming that the US constitutes approximately 20% of global feed consumption, the addressable demand for protein and oil in animal feed would be around $80 billion annually. Additionally, there is a significant incremental opportunity for using insect frass as fertilizer for plant health.

Figure 7: Addresable Target Market Potential in the US (2023, ‘000 Ton, B USD)

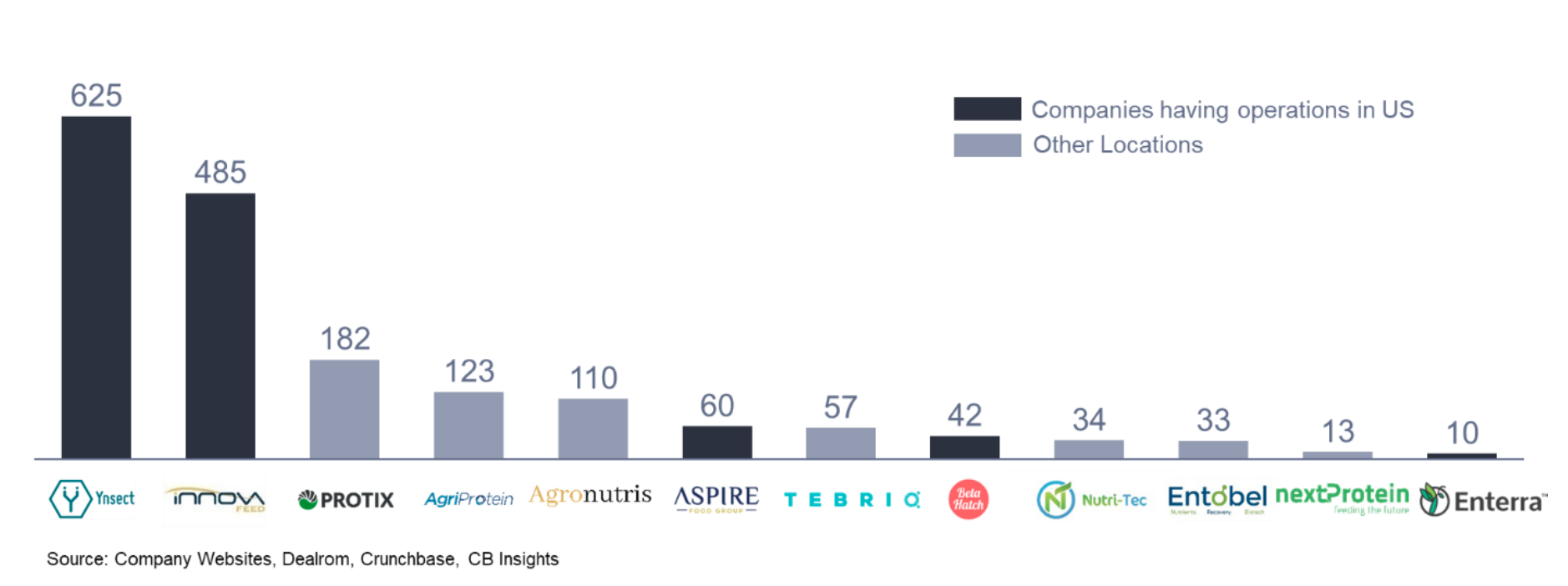

The size of the potential has been attracting ventures investing into insect rearing and farming in the last decade. InnovaFeed and Ynsect are two prominent players receiving >60% of overall funding. Notable investments include a $480M funding for InnovaFeed since 2016, and $435M funding for Ynsect since 2011. These investments are primarily aimed at supporting ambitious scale-up plans. Companies such as Cargill and ADM have also been investing in commercialization of insect protein in feed for poultry, aquaculture, and pet food.

The size of the potential has been attracting ventures investing into insect rearing and farming in the last decade. InnovaFeed and Ynsect are two prominent players receiving >60% of overall funding. Notable investments include a $480M funding for InnovaFeed since 2016, and $435M funding for Ynsect since 2011. These investments are primarily aimed at supporting ambitious scale-up plans. Companies such as Cargill and ADM have also been investing in commercialization of insect protein in feed for poultry, aquaculture, and pet food.

Figure 8: Total amount of investment received since foundation of insect farms (2008 – 2023, Million USD)

Navigating the potential shift in feed industry

Navigating the potential shift in feed industry

In conclusion, available evidence suggests that insects can serve as a viable alternative source of protein and fat for animal feed. There is potential to completely replace traditional protein and fat sources, such as soybean meal, soybean oil, fishmeal, fish oil, canola meal, cottonseed meal, sunflower meal, and meat & bone meal. This potential is due to the nutritional content and the observed growth performance of insect-based feed in various farm animals, including poultry, swine, pets, and aquaculture species. Consequently, the market potential for insect-based protein, oil, and by-product frass is substantial. Additionally, investment in insect farming has increased in the last decade. Potential shift to alternative protein source – insect – raises couple of key considerations.

- Potential Decline of Soybean & Fishmeal Demand in Animal Feed: Nearly 80% of soybeans are grown to feed animals and 10% of the global fish production goes to fishmeal for animal feed. Insects, an economically viable and nutritionally rich alternative protein source, could threaten existing protein and fat sources. Currently, the estimated capacity of insect-based protein production is approximately 100,000 metric tonnes globally. To put this into perspective, this amount is less than 0.5% of the US soybean disappearance used in animal feed. The capacity for insect-based protein production is estimated to reach 700,000 metric tonnes by the end of 2025, which would account for 3-4% of the US soybean disappearance in animal feed. Hence, insect-based protein as animal feed will capture a portion in soybean & its derivatives market in the next decade, driven by increasing investments.

- Soybean Processors’ Response: The potential decline in soybean demand is prompting major soybean processors, such as ADM, Cargill, and Bunge, to make significant investments and form partnerships with insect farming firms like InnovaFeed, Ynsect and Nutrition. This strategy aims to mitigate the risk associated with the potential decline in demand of soybean in animal feed. The scale and speed of their investments serve as key indicators of how swiftly the industry might transition from traditional feed sources to these insect-based alternatives.